The Andhra Pradesh Government Life Insurance (APGLI) bond is a unique scheme created to provide life insurance coverage to government employees in the state of Andhra Pradesh. It is a welfare initiative by the state government that ensures financial security for government employees and their families in the unfortunate event of their demise.

What is the APGLI ?

The Andhra Pradesh Government Life Insurance (APGLI) is a life insurance scheme that is specifically designed for the employees of the state government of Andhra Pradesh. The scheme was launched in 1961 with the aim of providing life insurance coverage to government employees at affordable rates. The APGLI policy is an endowment plan that offers life coverage to the policyholder, along with the potential to accumulate bonuses.

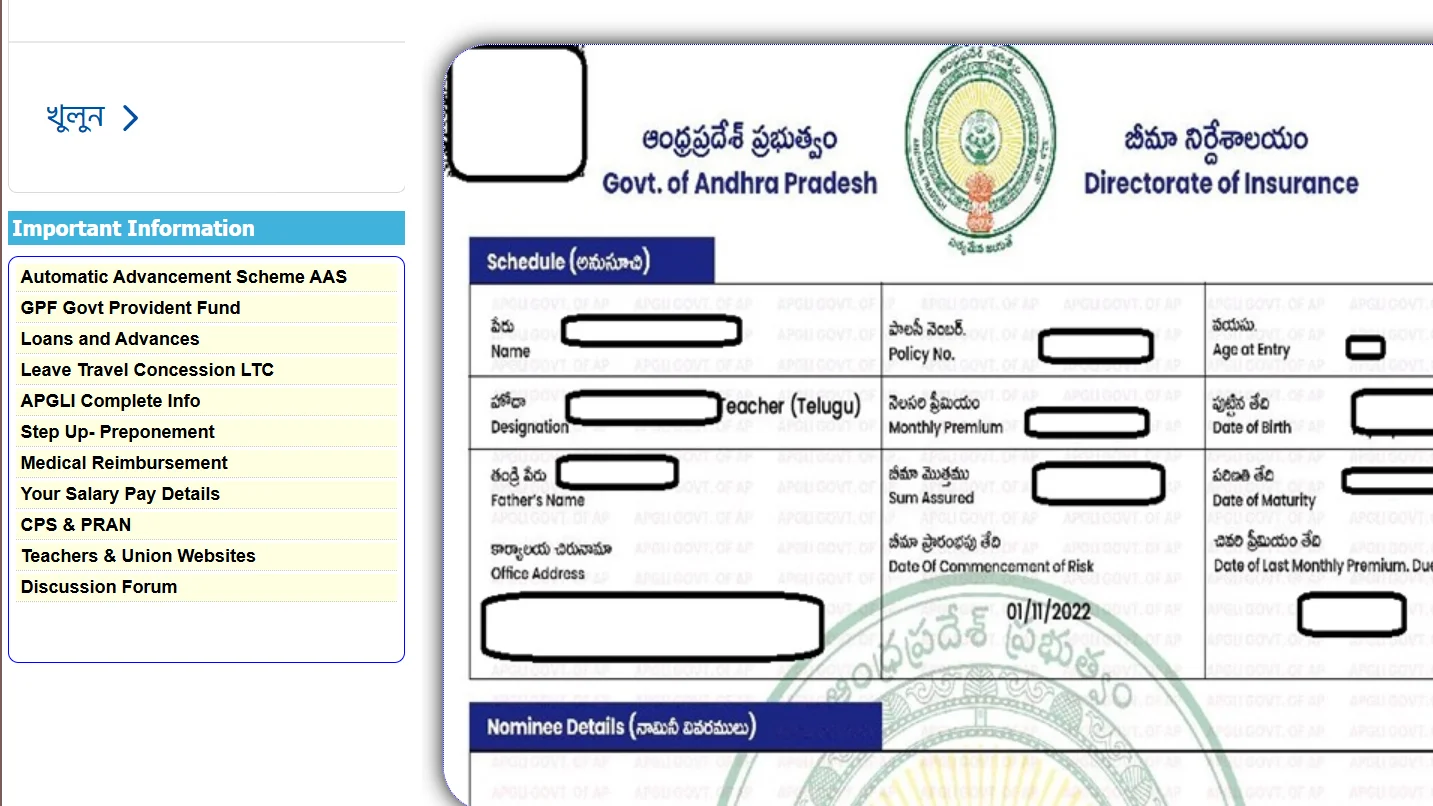

An APGLI bond is essentially a physical document that certifies that an individual has subscribed to the APGLI scheme and holds a valid life insurance policy under it. The bond contains important details like the policyholder’s name, the premium amount, the sum assured, and the maturity date.

Key Features of the APGLI Bond

The APGLI has several key features that make it an attractive option for government employees looking for life insurance coverage. These features include:

- Affordable Premiums: The APGLI policy is designed to be affordable for government employees, with premiums starting from as low as Rs. 5 per month. The premium amount is decided based on the sum assured and the age of the policyholder.

- Wide Coverage: The bond provides life insurance coverage that ensures the financial security of the employee’s family in case of an unfortunate event. The sum assured can range from Rs. 10,000 to Rs. 1 lakh, depending on the premium paid and the policy terms.

- Bonus Facility: The APGLI bond has a bonus facility that allows the policyholder to receive additional benefits in the form of bonuses. These bonuses accumulate over the life of the policy and increase the sum assured.

- Nominee Facility: The policyholder can nominate a beneficiary or family member who will receive the policy amount in the event of the policyholder’s demise.

- Tax Benefits: The premium paid for the APGLI policy is eligible for tax deductions under Section 80C of the Income Tax Act, 1961, making it an attractive option for tax-saving.

- Loan Facility: Policyholders can avail of loans against the value of their APGLI bond after it has gained sufficient maturity value.

APGLI Bond Status: How to Check?

Tracking the status of your APGLI bond is essential to ensure that your policy is active and your premiums are being paid on time. To check the APGLI bond status, follow the steps below:

- Visit the Official APGLI Portal: The first step is to visit the official APGLI portal at APGLI Portal.

- Enter Your Credentials: Once you’re on the portal, you will need to log in using your Employee Code and Password. These credentials are typically provided by your department or can be retrieved through the portal if you have forgotten them.

- Check the Status: After logging in, you can view the status of your APGLI bond under the “Policy Status” section. Here, you will find details such as whether the bond is active, the amount of premiums paid, and the sum assured.

- Download Your Bond Details: If you wish to download your APGLI details, you can click on the download link provided on the same page. This will allow you to save the details in PDF format for future reference.

- Visit the Department: If you face any issues while checking your bond status online, you can visit the APGLI office in your respective district or reach out to the concerned department to obtain more details.

How to Download APGLI Bond Details?

To download your APGLI bond details, you can follow these steps:

- Log in to the Portal: Go to the official APGLI portal and log in using your employee code and password.

- Navigate to the ‘Download’ Section: On the dashboard, you will find an option for downloading your bond details. This section may be labeled as “Download Policy Bond” or something similar.

- Select the Required Bond: Choose the APGLI bond for which you want the details. You may be required to select your policy number or other identifying information.

- Download the Details: After selecting the bond, click on the “Download” button. The bond details will be saved as a PDF file, which you can store on your computer or mobile device.

- Print the Bond: You can also print a physical copy of your APGLI bond details if required.

Understanding APGLI Policy Bond

An APGLI policy bond is the official document issued by the Andhra Pradesh government that certifies the existence of an insurance policy under the APGLI scheme. This bond contains all the essential details related to the policy, such as:

- Policyholder’s Name: The name of the government employee who holds the policy.

- Policy Number: A unique number assigned to each APGLI policy.

- Sum Assured: The amount the policyholder’s family will receive in the event of their demise.

- Premium Amount: The amount the policyholder is required to pay towards the policy at regular intervals.

- Maturity Date: The date when the policy matures and the sum assured is paid to the policyholder (if alive) or their nominee (in case of death).

- Nominee Name: The name of the person nominated to receive the policy amount in case of the policyholder’s death.

The APGLI policy bond acts as proof that the policyholder has a life insurance policy under the APGLI scheme, and it can be used when claiming benefits in case of an emergency.

APGLI Bond: Benefits to the Policyholder

- Financial Security: The primary benefit of the APGLI bond is that it provides financial protection to the policyholder’s family in case of an untimely death. The bond assures that the family will receive a sum of money to cover expenses and ensure financial stability.

- Low-Cost Coverage: The APGLI offers one of the most affordable life insurance plans in the country. Premiums start at a very low cost, making it accessible for all government employees.

- Bonus Accumulation: APGLI bonds accumulate bonuses over time, which are added to the sum assured. This can significantly increase the final payout at the time of maturity or claim.

- No Medical Tests: Unlike many commercial insurance policies, APGLI does not require medical tests for enrollment, making it an easy and hassle-free option for government employees.

- Tax Benefits: The premiums paid towards the APGLI bond are eligible for deductions under Section 80C of the Income Tax Act, providing tax savings for the policyholder.

- Loan Facility: Employees can avail themselves of loans against their APGLI policy bond if required, after it has accumulated sufficient value.

Latest Updates on APGLI Bond

As of 2025, there have been several updates to the APGLI system to improve accessibility and user experience:

- Digitalization of Records: The Andhra Pradesh government has digitized the APGLI records, making it easier for employees to track their policies, premiums, and bond status online.

- Mobile App for Easy Access: The government is working on a dedicated mobile application for APGLI bond management. This app will enable employees to access their policy information, download bond details, and make premium payments directly from their mobile phones.

- Increased Coverage: The state government has increased the sum assured for certain categories of government employees, offering higher insurance coverage for the same premium amount.

- Automatic Premium Payment: The APGLI system now allows employees to set up auto-payment for their premiums, ensuring that they never miss a payment and their policy remains active.

10 Frequently Asked Questions (FAQs) About APGLI Bond

- What is an APGLI bond? An APGLI bond is a life insurance policy certificate issued to Andhra Pradesh state government employees, offering life coverage with affordable premiums and tax benefits.

- How can I check my APGLI bond status? You can check your APGLI bond status by logging into the official APGLI portal and accessing the “Policy Status” section.

- How do I download my APGLI bond details? After logging in to the APGLI portal, you can navigate to the “Download Policy Bond” section and download your APGLI bond details in PDF format.

- Can I update my nominee details for the APGLI bond? Yes, you can update your nominee details through the APGLI portal by submitting the necessary documents.

- How do I avail a loan against my APGLI bond? You can apply for a loan against your APGLI policy bond by contacting the concerned department or visiting the APGLI office.

- Is there a tax benefit for APGLI bond holders? Yes, the premiums paid for an APGLI policy bond are eligible for deductions under Section 80C of the Income Tax Act.

- What happens if I miss a premium payment? If you miss a premium payment, your policy may lapse. You will need to pay the overdue premiums to reinstate the policy.

- What is the maturity period for an APGLI bond? The maturity period for an APGLI bond depends on the policy terms and can range from 5 to 30 years.

- Can I track my premium payments online? Yes, you can track your premium payments through the APGLI portal by logging in with your credentials.

- How can I get my APGLI bond after it matures? After the bond matures, the sum assured is paid to the policyholder or nominee, and the APGLI bond is surrendered at the APGLI office for processing.

Conclusion

The APGLI bond is an invaluable financial tool for government employees in Andhra Pradesh, providing life insurance coverage at an affordable cost. With the ability to track policy status, download bond details, and access additional services online, employees can now manage their insurance policies easily and efficiently. The APGLI scheme continues to evolve, offering enhanced benefits and more convenient ways to manage bonds.

Also Read: AEPDS Bihar: A Comprehensive Guide to the Public Distribution System in Bihar

Also visit: Online Legal Service, Virtual Advice and Consultation

Also Read: The Complete Guide to Kibho and its Crypto Ecosystem

Also Read: Difference Between Public and Private Company: An In-Depth Guide