The Goods and Services Tax (GST) regime in India has made a significant impact on the country’s indirect tax structure, consolidating multiple taxes under one umbrella. A crucial element of the GST process is the Application Reference Number (ARN), a unique identifier assigned to each GST application. This ARN allows taxpayers to track the progress of their GST application, be it for registration, return filing, or other GST-related procedures. Understanding how to check your GST ARN status, what it means, and how it affects your GST compliance is essential for any business operating under this taxation system.

What is GST ARN?

GST ARN (Application Reference Number) is a unique identification number provided by the GST portal when you apply for any GST-related process such as GST registration. This number acts as a reference point to track the status of your application and helps streamline the processing of your GST registration, GST returns, or other related matters.

When you apply for GST registration, you submit an application through the GST Common Portal. Upon successful submission, you are assigned an ARN, which you can use to track the progress of your application. Whether it’s your GST registration or a GST return filing, the ARN status serves as an official acknowledgment of your application and ensures transparency in the process.

Importance of GST ARN

The GST ARN is crucial because it:

- Serves as a Unique Identifier: Each GST application is assigned a unique ARN, making it easy to track and monitor the progress of your application.

- Tracks the Application Status: The ARN allows taxpayers to track the real-time status of their application, whether it’s pending, approved, or rejected.

- Assists in Timely Filing: By knowing the status of your GST application, you can ensure you are adhering to timelines for filing GST returns or other compliances.

- Helps with Document Clarification: If any documents are required, the GST ARN status will inform you of pending documents or clarifications needed.

- Acts as a Reference for GST Helpdesk: In case you face issues, the GST ARN serves as a reference number for queries raised with the GST helpdesk.

How to Track Your GST ARN Status?

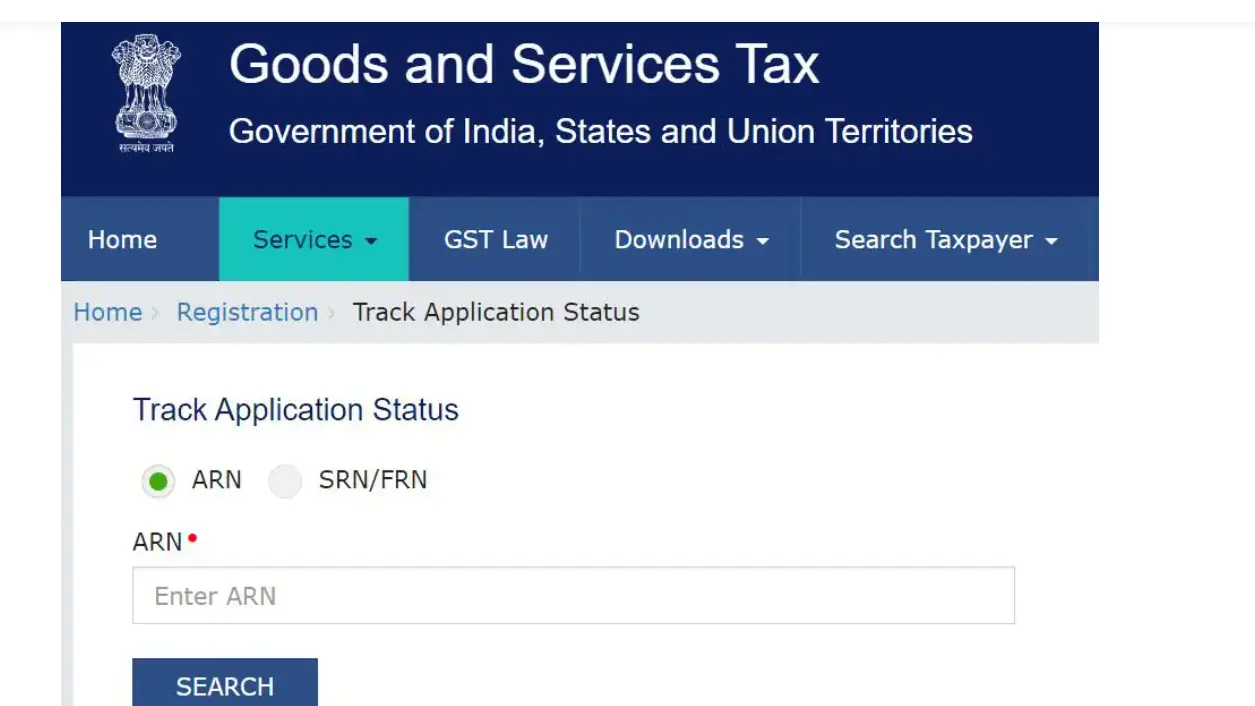

The process of tracking your GST ARN status is simple and straightforward. You can track your GST application status through the GST Common Portal or other third-party websites such as Boweb. Below are the steps to track your GST ARN status on the official GST portal:

Steps to Track GST ARN Status via GST Portal:

- Visit the GST Portal: Go to the official GST website at https://www.gst.gov.in.

- Navigate to the ‘Track Application Status’ Section: On the homepage of the GST portal, look for the “Track Application Status” link. You can find this under the ‘Services’ tab or in the GST Registration section.

- Enter Your ARN: Enter the ARN provided to you when you submitted your GST application. This number is unique to your application and allows you to track it.

- Submit and View Status: Once you enter your ARN, click on ‘Track’ or ‘Submit.’ You will be redirected to a page that shows the status of your application, including whether it is ‘Pending,’ ‘Approved,’ or ‘Rejected.’

Tracking GST ARN Status via Third-Party Portals (e.g., Boweb):

Third-party portals such as Boweb offer additional tracking features for GST-related matters, such as GST return status, GST registration status, and other GST-related services. These platforms often provide user-friendly interfaces and additional tools to simplify GST compliance.

- Go to Boweb GST Portal: Visit the Boweb website, which specializes in GST-related tracking and assistance.

- Enter ARN Number: Similar to the official GST portal, you will need to input your ARN number in the appropriate field.

- Check Status: After submitting your ARN, the portal will display your application’s status in real-time.

Different GST ARN Statuses

When you track your GST ARN status, you may come across different statuses, each signifying a specific stage in the GST application process. Some of the common statuses you might encounter are:

- Application Submitted: This status indicates that the application has been successfully submitted but has not yet been processed by the authorities.

- Pending: This status means that the application is still under review by the GST authorities, and no final decision has been made. You may need to provide additional documents or information to proceed.

- Approved: If your application has been processed successfully and all requirements are met, the status will show “Approved.” This means that your GST registration is complete.

- Rejected: If there were issues with your application (e.g., incomplete documents or incorrect details), it may be rejected, and the status will display as “Rejected.”

- Clarification Needed: If the GST authorities require further details or clarification on the application, the status will show “Clarification Required.” You may need to provide additional information or correct mistakes before the application can proceed.

- GST Application Withdrawn: If you decide to withdraw your application for GST registration or any other GST process, the status will indicate “Application Withdrawn.”

GST Registration Process

The GST registration process is a crucial part of the GST system. To get registered under GST, you need to complete the following steps:

Step 1: Visit the GST Portal

Go to the official GST Common Portal at www.gst.gov.in. This is where you can submit your GST registration application.

Step 2: Fill in the Application Form

To begin the registration process, click on the “Register Now” button and complete the application form. You will be required to provide your business details, such as the legal name, PAN number, business type, and address.

Step 3: Upload Supporting Documents

As part of the registration process, you must submit documents such as identity proof, business address proof, bank details, and other supporting documents.

Step 4: Submit the Application and Obtain ARN

After filling in the necessary details and uploading documents, submit your application. Upon successful submission, you will receive an ARN, which you can use to track the status of your registration.

Step 5: Wait for Processing and Final Approval

The GST authorities will verify your application and documents. If everything is in order, your registration will be approved, and you will receive your GSTIN (GST Identification Number). If there are any issues, the authorities may request additional information.

Step 6: Receive GST Registration Certificate

Once your registration is approved, you will receive your GST Registration Certificate, which allows you to collect taxes and comply with GST regulations.

P.C. – tatanexarc.com

GST on Cars: Understanding the Tax Structure

The GST system applies to a wide range of goods and services, including vehicles like cars. Under the GST framework, cars are categorized into different segments, each attracting a different GST rate. The tax rates on cars depend on factors such as the type of vehicle, engine capacity, and its intended use.

- Luxury Cars: Luxury vehicles are subject to a high GST rate of 28%, along with an additional cess, which can vary based on the car’s price and engine size.

- Electric Vehicles (EVs): To promote environmentally friendly transportation, electric vehicles are subject to a reduced GST rate of 5%.

- Used Cars: Used cars attract GST at 12%, and input tax credit (ITC) can be claimed under certain conditions.

- Two-Wheelers: Two-wheelers are generally taxed at a rate of 28%, similar to luxury cars, though this may vary depending on the specifics of the vehicle.

For a detailed breakdown of GST on cars, including exemptions and input tax credit rules, you can refer to the official GST rates page.

GST Return Status: How to Check and File GST Returns

Filing GST returns is an ongoing requirement for businesses registered under GST. After receiving your GSTIN, you need to regularly file returns to report your sales, purchases, and tax liabilities. The GST portal offers a way to track your return filing status.

Steps to Check GST Return Status:

- Login to the GST Portal: Go to www.gst.gov.in and log in with your GST credentials.

- Navigate to the Returns Dashboard: Once logged in, go to the “Returns Dashboard” section, where you can see the status of your filed returns.

- Check the Status: The dashboard will show whether your return has been successfully filed, is pending, or is awaiting approval.

BOWeb and Internal GST

BOWeb is an online tool often used by businesses and tax consultants to track various GST-related processes, including tracking GST returns and applications. It helps with efficient management of GST records and compliance. BOWeb also supports businesses in ensuring that they meet their tax obligations, file timely returns, and resolve any GST-related issues.

GST Helpdesk: Your Support System for GST Issues

The GST Helpdesk is available to assist businesses with any issues they face in registering under GST, filing returns, or managing their ARN status. The helpdesk can also assist with resolving any technical glitches or errors encountered during the GST registration process.

How to File a GST Complaint

If you encounter any issues with your GST registration, filing, or ARN tracking, you can file a complaint through the GST Helpdesk. The process to file a complaint is as follows:

- Log in to the GST Portal: Visit www.gst.gov.in and log in with your credentials.

- Navigate to the Complaints Section: Go to the “Grievance Redressal” section of the GST portal.

- Submit Your Complaint: Provide a detailed description of the issue you are facing, along with any necessary documentation.

- Follow Up: You will receive a response from the GST authorities, and any necessary corrective measures will be taken.

FAQs about GST ARN Status

- What is GST ARN?

- GST ARN is a unique number given to you after submitting a GST application, which allows you to track the status of your application.

- How can I track the status of my GST ARN?

- You can track your GST ARN status by visiting the GST portal and entering your ARN number in the “Track Application Status” section.

- What should I do if my GST application is rejected?

- If your application is rejected, review the rejection reasons and resubmit your application with the required corrections.

- Is GST applicable on used cars?

- Yes, used cars attract a GST rate of 12%, and input tax credit can be claimed in certain conditions.

- How can I file GST returns?

- To file GST returns, log in to the GST portal, go to the “Returns Dashboard,” and follow the process to submit your returns.

- How do I check the status of my GST return?

- The status of your GST return can be checked on the “Returns Dashboard” section of the GST portal.

- What does ‘Pending’ mean in the GST ARN status?

- If your GST ARN status shows “Pending,” it means your application is still under review.

- Can I track my GST ARN status using Boweb?

- Yes, Boweb offers tools for tracking your GST ARN status, returns, and other GST-related services.

- What is the GST Helpdesk?

- The GST Helpdesk provides assistance to businesses with issues related to registration, filing returns, and other GST matters.

- How do I file a GST complaint?

- Complaints can be filed through the “Grievance Redressal” section of the GST portal, where you can submit your issue for resolution.

Conclusion

The GST ARN status is an essential tool for monitoring the progress of your GST application, whether it’s for registration, return filing, or any other related process. By understanding the process of tracking ARN status, registering under GST, and filing GST returns, businesses can ensure that they remain compliant with the tax laws. Whether you’re concerned about GST on cars, navigating the GST Common Portal, or seeking help from the GST Helpdesk, having a clear understanding of these processes is critical for a smooth and efficient GST experience.

Stay updated with the latest GST norms and ensure that your business complies with the tax requirements for successful growth.

Citations:

Also Read: Understanding E-Way Bill Limit: A Comprehensive Guide

Also visit: Online Legal Service, Virtual Advice and Consultation

Also Read: Trademark Class List: A Comprehensive Guide for Trademark Registration

Also Read: Comprehensive Guide to Inter-State Meaning in GST: Understanding the Complexities of Interstate Transactions