A contingent contract is a type of agreement whose execution and performance are contingent on the occurrence or non-occurrence of a specific event. The term “contingent” here means that the contract is dependent on a future event that is uncertain. Such contracts are a core part of legal frameworks, particularly in contexts where future events that are beyond the control of the parties involved influence the enforceability of the contract.

Understanding contingent contracts is vital for individuals, businesses, and institutions engaging in agreements tied to uncertain events such as insurance policies, employment contracts, construction contracts, and various agreements that deal with the potential occurrence of future events.

Table of Contents

1. Defining Contingent Contracts: Legal Foundation and Conceptual Framework

A contingent contract is primarily defined in Section 31 of the Indian Contract Act, 1872. The section provides the following explanation:

- Section 31 of the Indian Contract Act, 1872 defines a contingent contract as one whose performance depends upon the occurrence of a future uncertain event. If the event happens, the contract becomes enforceable, and if it does not happen, the contract is void.

In simpler terms, contingent contracts are agreements that become valid and enforceable only if a particular future event occurs. The event is uncertain, but the parties to the contract agree that their obligations depend on the happening or non-happening of that event.

Example: An insurance policy is a perfect example of a contingent contract. The insurer agrees to pay the insured a sum of money if an accident occurs. If the accident does not happen, the insurer is not required to make any payment.

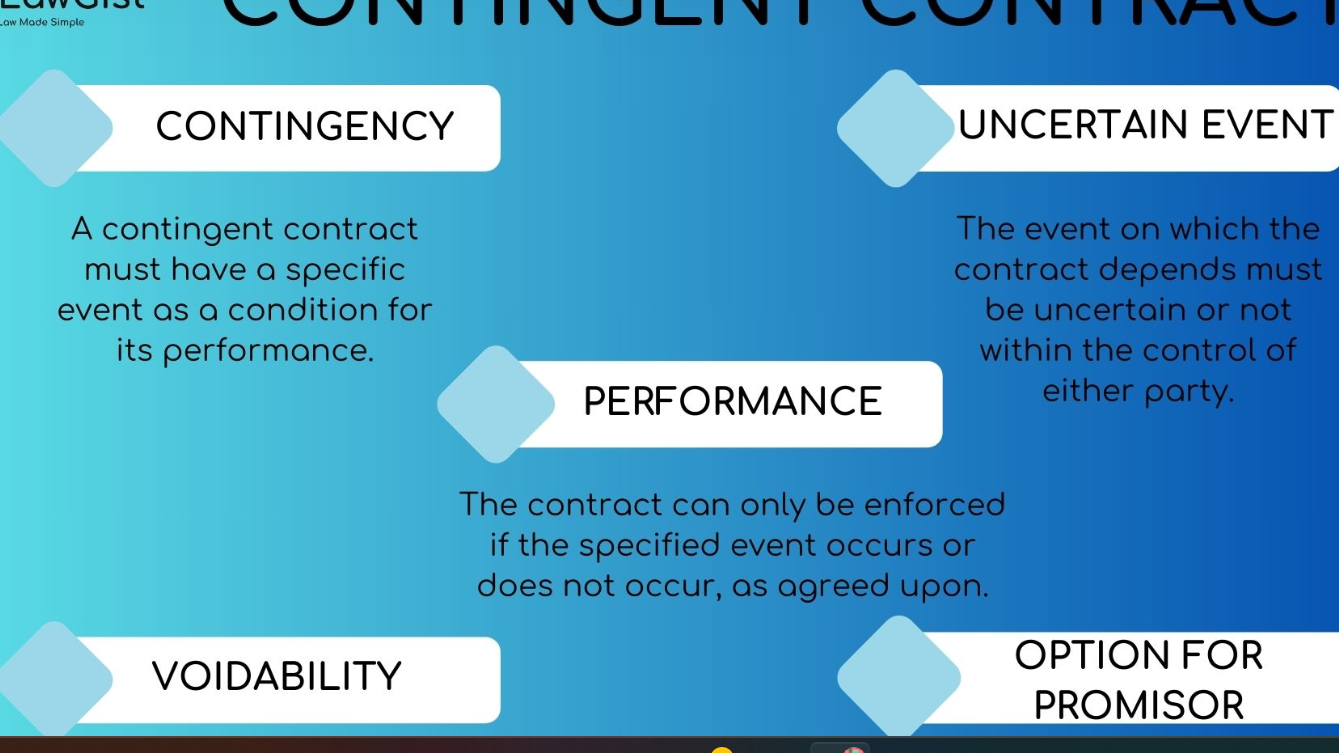

2. Key Characteristics of Contingent Contracts

To better understand contingent contracts, it’s important to delve deeper into their key characteristics:

- Dependency on a Future Event: The essence of a contingent contract lies in its dependency on a future event. This event must be uncertain and is not within the control of either party. It could either be the happening or non-happening of an event. This future event is what dictates whether the contract becomes enforceable or not.

- Uncertainty of the Event: The event that triggers the performance of the contract is uncertain. If the event is certain, the contract is not contingent. The uncertainty factor is crucial, as it makes the contract enforceable only when the event occurs.

- Non-Enforceability without the Event: A contingent contract cannot be enforced until the uncertain event occurs. If the event never happens, the contract will not come into play. Therefore, until the event occurs or is confirmed as non-occurring, the contract remains inoperative.

- Possibility of Non-Performance: Since the event on which the performance of the contract depends is uncertain, there exists the possibility that the event may not happen, leading to the non-performance of the contract.

- Legal Effect of the Event: The occurrence of the contingent event determines the contractual obligation of the parties involved. Once the event happens, the parties are bound by their contractual promises.

3. Legal Provisions and Interpretation Under Indian Law

The concept of contingent contracts is encapsulated within the Indian Contract Act, 1872, with Section 31 being the primary section governing them. However, other provisions within the Act also deal with the enforceability and legality of contracts that depend on uncertain events. Let’s explore the legal provisions and principles under which contingent contracts are governed:

- Section 31 of the Indian Contract Act, 1872, defines a contingent contract as one that is dependent on a future uncertain event.

- Section 32 further elaborates that contingent contracts become void if the event on which they are based is impossible to occur.

- Section 56 addresses contracts that involve the performance of an act that is impossible or becomes impossible due to circumstances. This aligns with the treatment of contingent contracts, as a contract based on an impossible event would be void under this section.

4. Types of Contingent Contracts

Contingent contracts are not monolithic but can be classified into different categories based on how they relate to the event upon which they depend. Let’s break down the two main types of contingent contracts:

a) Condition Precedent

A condition precedent refers to an event that must occur before the performance of the contract can happen. In other words, the obligation to perform the contract is conditional upon the occurrence of a certain event. If the event does not occur, the contract remains non-enforceable.

Example: A person agrees to buy a house only if they are able to secure a bank loan. In this case, securing the loan is the condition precedent to the performance of the contract.

b) Condition Subsequent

A condition subsequent is an event that terminates an existing contractual obligation. In this case, the contract becomes valid, but its performance is contingent upon the happening of a future event. If the event occurs, the contract is discharged, or the obligations may be terminated.

Example: An employee signs a contract to work for a company unless a specific event occurs, such as the employee failing a medical exam. If the employee fails the medical exam, the contract can be terminated.

P.C. – thelawgist.org

5. Real-World Examples of Contingent Contracts

Contingent contracts are prevalent in many sectors where outcomes rely on uncertain future events. Let’s explore some common real-world examples:

1. Insurance Contracts

One of the most well-known examples of contingent contracts is insurance policies. An individual or entity purchases an insurance policy contingent on certain events happening in the future (e.g., death, fire, accident, etc.). If the insured event occurs, the insurance company is obligated to pay the agreed amount to the insured or the beneficiary. If the event does not occur, the insurer is not required to make any payment.

2. Construction and Real Estate Contracts

In the real estate sector, agreements are often contingent on the approval of a loan or the securing of building permits. If these contingencies are met, the contract becomes enforceable, and the parties are bound to carry out their respective duties, such as transferring the property or completing the construction.

3. Employment Contracts

In some employment contracts, the terms of employment are contingent on certain conditions, such as the successful completion of a probation period or passing a medical test. These conditions must be met for the employee to be officially hired or to continue their employment.

4. Sale of Goods

A seller might enter into a contract to sell goods contingent upon their delivery by a specific date or the condition that the buyer secures financing. If the goods are not delivered or the financing is not secured, the contract would not be enforceable.

6. Legal Consequences of Breach of Contingent Contracts

As with any type of contract, the breach of a contingent contract leads to legal consequences. However, contingent contracts introduce certain complexities due to their dependence on uncertain future events. Here’s a closer look at what happens when a contingent contract is breached:

a) When the Contingent Event Does Not Occur

If the contingent event does not occur, the contract becomes void, and the parties are no longer obligated to perform their duties. There are no legal consequences for non-performance in such cases, as the event itself was uncertain, and the contract was contingent upon it.

b) When the Contingent Event Occurs, but the Party Fails to Perform

If the contingent event occurs but one party fails to fulfill their obligations under the contract, this constitutes a breach of contract. In such cases, the non-breaching party has the right to seek damages or specific performance under the relevant provisions of the Indian Contract Act.

c) When the Event is Impossible

If the event on which the contingent contract is based turns out to be impossible, then the contract becomes void as per Section 56 of the Indian Contract Act, 1872. A contract based on an impossible event is legally unenforceable.

7. The Doctrine of Impossibility in Contingent Contracts

The doctrine of impossibility plays a significant role in contingent contracts, as it defines the legal consequences when an event turns out to be impossible. Under Section 56 of the Indian Contract Act, any contract that becomes impossible to perform due to the occurrence of an impossible event is rendered void. This concept is particularly relevant for contingent contracts, where the future event may either be possible or impossible.

For example, if a contract is made to transfer ownership of property contingent upon the buyer passing a medical test, but the medical test turns out to be impossible or invalid, the contract would be void.

8. Smart Contracts: The Future of Contingent Contracts

With the rise of blockchain technology and smart contracts, the concept of contingent contracts is evolving. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts are contingent on specific events and can automatically execute actions (like transferring money or assets) when predefined conditions are met. Since smart contracts are digital and decentralized, they reduce the need for intermediaries and provide enhanced security and transparency.

Smart contracts represent a major shift in the traditional approach to contingent contracts, as they operate on blockchain platforms that ensure the enforcement of contracts based on agreed conditions, without requiring the intervention of lawyers or courts.

9. The Importance of Drafting Contingent Contracts

Contingent contracts require careful drafting to ensure clarity, enforceability, and avoid legal disputes. The terms of the event, conditions for performance, and the consequences of non-performance or breach must be clearly defined. Any ambiguity in the terms may lead to a contract becoming void or difficult to enforce.

When drafting a contingent contract, it is essential to:

- Specify the contingent event clearly: Clearly define the uncertain event that triggers the performance of the contract.

- Ensure the event is possible: Avoid including impossible events that would make the contract void.

- Define performance obligations: Ensure that the parties’ obligations are clearly defined once the event occurs.

- Include provisions for breach: Define the consequences of non-performance or breach if the event occurs.

10. Frequently Asked Questions (FAQs) on Contingent Contracts

- What is a contingent contract? A contingent contract is an agreement that depends on the occurrence or non-occurrence of a future uncertain event.

- How does a contingent contract differ from an ordinary contract? A contingent contract becomes enforceable only when the uncertain event occurs, while an ordinary contract is enforceable immediately after it is made.

- What types of events can form the basis of a contingent contract? The event can be related to various conditions such as accidents, death, property sales, or even financial events like loan approval or performance in exams.

- Is an insurance contract a contingent contract? Yes, insurance contracts are classic examples of contingent contracts because the insurer’s obligation depends on the occurrence of the insured event.

- What happens if the contingent event is impossible? If the event on which the contingent contract is based is impossible, the contract becomes void, as per Section 56 of the Indian Contract Act.

- Can a contingent contract be enforced if the event does not occur? No, a contingent contract cannot be enforced if the event does not occur or is proven to be impossible.

- What are the legal consequences of breaching a contingent contract? The breach can lead to damages or specific performance if the event has occurred but one party fails to perform.

- How are smart contracts related to contingent contracts? Smart contracts are digital, self-executing contracts based on contingent terms. They automatically perform actions when the predefined event occurs, without intermediaries.

- Are contingent contracts commonly used in the real world? Yes, contingent contracts are widely used in industries such as insurance, construction, real estate, and employment contracts.

- What are the risks associated with contingent contracts? Risks include ambiguity in defining the contingent event, impossibility of performance, and disputes over whether the event has occurred as required by the contract.

Conclusion

A contingent contract is a legal agreement whose performance is contingent on the occurrence of an uncertain future event. Understanding contingent contracts is essential for anyone entering into agreements that involve uncertainties, such as insurance policies, real estate contracts, or employment agreements.

The Indian Contract Act, 1872, provides the legal framework for contingent contracts, ensuring that such contracts are enforceable only if the event they depend on occurs. However, the modern digital era, with the advent of smart contracts and blockchain technology, is transforming the landscape of contingent contracts by making them more secure, efficient, and self-executing.

By carefully considering the nature of contingent events, drafting clear terms, and understanding the potential legal consequences, individuals and businesses can navigate contingent contracts effectively, minimizing risks and ensuring the enforceability of their agreements.

Also Read: The 106th Amendment of the Indian Constitution: A Comprehensive Overview

Also visit: Online Legal Service, Virtual Advice and Consultation

Also Read: Understanding the 105th Amendment of the Indian Constitution: A Comprehensive Analysis