The Goods and Services Tax (GST) is one of the most significant reforms in the Indian tax system, aimed at simplifying tax structure and fostering ease of doing business. While the implementation of GST has resulted in substantial improvements, understanding the intricacies of interstate and intrastate transactions under GST remains a critical area for businesses.

Table of Contents:

- What is Inter State Meaning in GST?

- Types of GST: Understanding the Structure

- IGST Full Form: Integrated Goods and Services Tax

- CGST Full Form: Central Goods and Services Tax

- SGST Full Form: State Goods and Services Tax

- Interstate vs. Intrastate Transactions under GST

- Rules for Inter-State Supply of Goods and Services

- The Tax Implications of Inter-State Transactions

- Common Examples of Inter-State Transactions

- Impact of GST on Businesses: Interstate Trade

- 10 Frequently Asked Questions on Inter-State Transactions in GST

- Conclusion

1. What is Inter-State Meaning in GST?

Under the Goods and Services Tax (GST) regime, the term interstate refers to the supply of goods or services between two or more states. It is one of the two major classifications of supply under GST, the other being intrastate supply, where the movement of goods or services happens within a single state.

In an interstate transaction, goods or services are supplied from one state to another. The definition of interstate transactions under GST is important for determining which tax regime applies and how the tax is calculated and paid. When there is a sale of goods or services across state borders, the transaction is considered interstate supply, and IGST (Integrated Goods and Services Tax) applies.

In simple terms, an interstate transaction refers to business dealings where the buyer and the seller are in different states of India. This can involve:

- The transfer of goods from one state to another.

- The provision of services where the supplier and recipient are in different states.

Example of Interstate Supply:

- A business in Maharashtra sells goods to a customer in Gujarat.

- A consulting firm based in Delhi offers services to a company in Karnataka.

In these examples, both transactions are interstate transactions because the location of the supplier and the recipient are in different states.

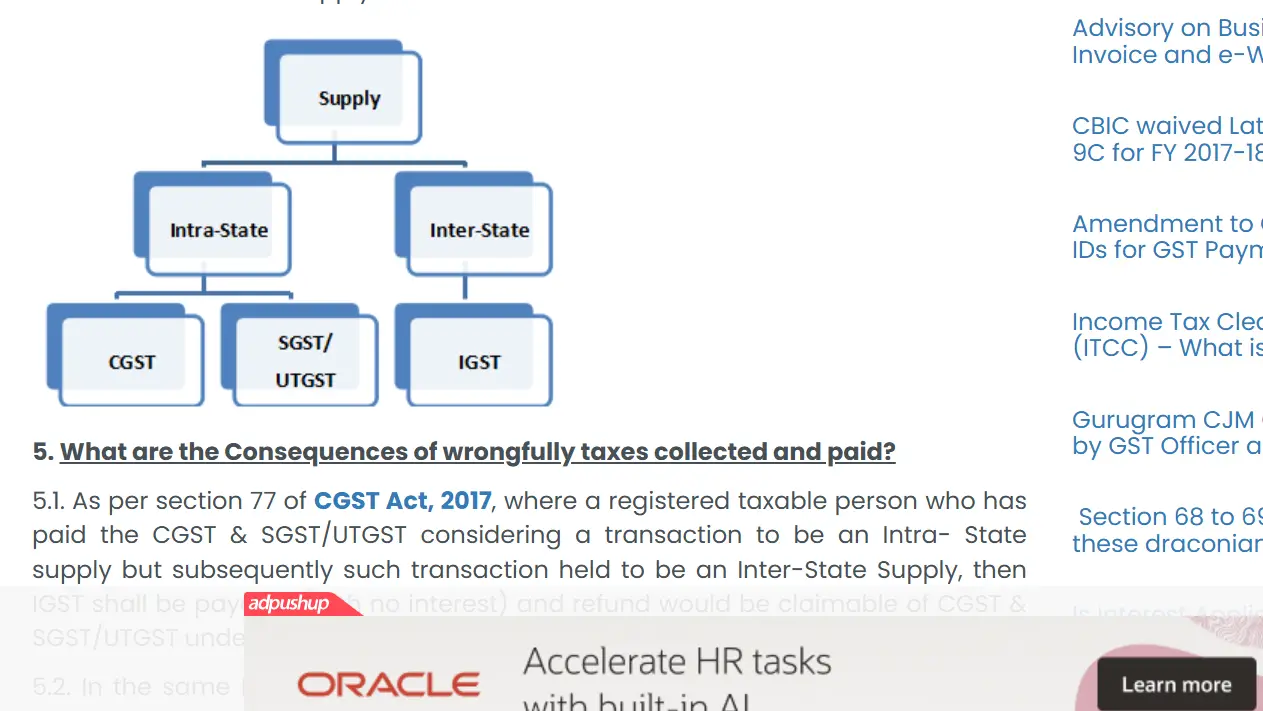

2. Types of GST: Understanding the Structure

GST is a multi-layered taxation system, with the primary goal of streamlining tax laws. It is divided into several types based on the nature of the transaction. The types of GST that are essential to understand for interstate transactions are:

1. CGST (Central Goods and Services Tax):

This tax is levied by the central government on the supply of goods and services within the same state. In case of intrastate supply, where both the buyer and the seller are within the same state, CGST is applicable.

2. SGST (State Goods and Services Tax):

SGST is similar to CGST, but it is levied by the state government. It is applicable on intrastate transactions (within the same state) alongside CGST. The proceeds from SGST are collected by the state government where the transaction takes place.

3. IGST (Integrated Goods and Services Tax):

IGST is applicable for interstate transactions (when the buyer and seller are in different states). The primary aim of IGST is to ensure a seamless flow of tax credits across state borders. IGST is a combination of CGST and SGST and is levied by the central government on interstate supplies. The proceeds from IGST are divided between the central and state governments.

These three types of taxes (CGST, SGST, and IGST) make up the foundation of GST in India and are designed to eliminate the cascading effect of taxes. The primary difference lies in their jurisdiction:

- CGST and SGST apply to intrastate transactions.

- IGST applies to interstate transactions.

3. IGST Full Form: Integrated Goods and Services Tax

IGST stands for Integrated Goods and Services Tax, which is levied on interstate transactions. IGST is designed to ensure that there is no loss of tax revenue for the states when goods or services are supplied between different states.

The main objective of IGST is to facilitate the seamless flow of tax credits between states, preventing the taxation of goods or services twice and ensuring that both the buyer and seller are able to claim their respective credits.

How IGST Works:

- Tax Collection: IGST is collected by the central government.

- Distribution of Revenue: When IGST is collected, the central government shares a portion of it with the respective states based on the destination of the goods or services (i.e., where the goods are consumed).

- Input Tax Credit: Businesses can claim input tax credit for the IGST paid on their purchases against the IGST, CGST, or SGST that they collect on their sales.

Example: If a manufacturer in Maharashtra sells goods worth ₹1,00,000 to a distributor in Uttar Pradesh, the applicable tax will be IGST at 18%. The tax on the sale will be ₹18,000, which is paid to the central government.

4. CGST Full Form: Central Goods and Services Tax

CGST refers to the Central Goods and Services Tax and is levied by the central government on transactions within a single state. CGST is applied alongside SGST in the case of intrastate transactions, which are when the supply of goods or services happens within the same state.

For example, if a supplier in Kolkata sells goods to a buyer in the same city, CGST is levied on the sale of those goods.

Key Points about CGST:

- It applies to intrastate transactions.

- The tax revenue from CGST is collected by the central government.

- CGST is charged along with SGST for transactions within the same state.

5. SGST Full Form: State Goods and Services Tax

SGST stands for State Goods and Services Tax and is levied by state governments. It is applicable in the case of intrastate transactions, where both the buyer and the seller are located within the same state.

Key Points about SGST:

- SGST applies to intrastate transactions.

- The revenue collected from SGST is credited to the respective state government’s account.

- SGST is collected along with CGST for transactions that occur within the same state.

6. Interstate vs. Intrastate Transactions under GST

In the context of GST, interstate and intrastate transactions are two distinct categories. The classification of a transaction into either interstate or intrastate determines the type of tax (CGST, SGST, or IGST) applicable to the transaction.

1. Interstate Transactions:

- Occur between two different states.

- IGST is applicable on the supply of goods or services.

- Both the buyer and the seller are located in different states.

2. Intrastate Transactions:

- Occur within the same state.

- CGST and SGST are applicable on the supply of goods or services.

- The buyer and the seller are located within the same state.

7. Rules for Inter-State Supply of Goods and Services

Interstate supply refers to the movement of goods or services between different states. The following rules apply to interstate transactions under GST:

- Place of Supply: For the purpose of determining interstate or intrastate supply, the place of supply is crucial. The place of supply is the location where the goods are delivered or where the service is provided.

- Tax Liability: The supplier is liable to collect and remit IGST to the central government in interstate transactions. If the transaction involves a purchase, the buyer can claim an input tax credit on the IGST paid.

- Exports and Imports: Exports are also considered interstate transactions and are subject to zero-rated IGST, meaning no tax is levied on export goods or services. Similarly, imports are treated as interstate transactions.

P.C. – taxguru.in

8. The Tax Implications of Inter-State Transactions

Interstate transactions under GST have important tax implications:

- Input Tax Credit (ITC): Businesses engaged in interstate transactions can claim an input tax credit for the IGST paid, provided they use the goods or services for business purposes.

- GST Registration: Businesses involved in interstate transactions must obtain GST registration, irrespective of their turnover, because GST is applicable to such transactions.

- Tax Credit Flow: The IGST mechanism ensures that tax credits flow seamlessly between the states. For example, a seller can claim the IGST paid on their purchases as input tax credit and set it off against the IGST, CGST, or SGST they collect on their sales.

9. Common Examples of Inter-State Transactions

Here are some typical examples of interstate supply:

- Goods Exported from Maharashtra to Gujarat: A manufacturer in Maharashtra sends goods worth ₹50,000 to a retailer in Gujarat. IGST will apply on this sale, and the manufacturer will pay the IGST to the central government.

- Online Sale of Goods: A customer in Uttar Pradesh orders goods from an e-commerce platform based in Delhi. The e-commerce platform will charge IGST on the sale and remit it to the central government.

10. Impact of GST on Businesses: Interstate Trade

GST has had a transformative impact on interstate trade in India by removing barriers to the free flow of goods and services. The key benefits for businesses are:

- Ease of Doing Business: GST has replaced the previous system of multiple taxes, making interstate trade simpler and less cumbersome.

- Uniform Taxation: The introduction of IGST has ensured a uniform taxation system across states, eliminating the need for complex inter-state tax calculations.

- Faster Movement of Goods: With GST, the movement of goods between states is more efficient, reducing delays at checkpoints and enabling quicker delivery.

11. 10 Frequently Asked Questions on Inter-State Transactions in GST

- What is the difference between interstate and intrastate transactions under GST?

- Interstate transactions occur between different states, while intrastate transactions occur within the same state. Interstate transactions are subject to IGST, and intrastate transactions are subject to CGST and SGST.

- Is IGST applicable on exports?

- Yes, exports are treated as interstate transactions and are subject to zero-rated IGST, meaning no tax is levied on export goods or services.

- Who pays the IGST in an interstate transaction?

- The seller or supplier is responsible for collecting and remitting IGST to the central government in an interstate transaction.

- Can businesses claim input tax credit for IGST paid?

- Yes, businesses can claim input tax credit for IGST paid on purchases, which can be set off against IGST, CGST, or SGST on sales.

- What is the role of IGST in interstate supply?

- IGST ensures a smooth flow of tax credits and avoids double taxation on interstate transactions.

- How is IGST calculated?

- IGST is calculated based on the sale price of the goods or services, and the applicable IGST rate (which can be 5%, 12%, 18%, or 28%).

- Is GST registration mandatory for interstate transactions?

- Yes, businesses engaging in interstate transactions are required to obtain GST registration.

- What happens if IGST is not paid on interstate supply?

- If IGST is not paid on interstate supply, the supplier may be liable for penalties and interest charges.

- Are sales to SEZ units considered interstate transactions?

- Yes, sales to Special Economic Zones (SEZ) are considered interstate transactions and are subject to zero-rated IGST.

- What is the treatment of interstate supply in case of stock transfer?

- Stock transfers between different states are treated as interstate transactions, and IGST is applicable on such supplies.

12. Conclusion

Understanding the concept of interstate transactions in GST is crucial for businesses operating across state boundaries. IGST, CGST, and SGST each play specific roles in ensuring a smooth and efficient tax system that fosters interstate trade. By comprehending the regulations surrounding interstate transactions, businesses can optimize their tax liabilities, ensure compliance, and avoid penalties.

For more information and official resources, refer to the following government websites:

Also Read: Comprehensive Guide to TDS on Sale of Property

Also visit: Online Legal Service, Virtual Advice and Consultation