The Indian Income Tax Act offers various deductions to taxpayers to reduce their taxable income and provide financial relief. One of the most beneficial provisions for homebuyers is Section 80EEA. This section allows individuals to claim tax benefits on home loan interest payments. In a growing real estate market, where home loan interest rates can be substantial, the 80EEA deduction offers valuable assistance in reducing tax liability.

Table of Contents

What is Section 80EEA?

Section 80EEA of the Income Tax Act provides an additional deduction of up to ₹1.5 lakh on the interest paid on home loans for the purchase of a residential property. This section was introduced in the Budget 2019 to promote affordable housing and encourage first-time homebuyers. The main goal of Section 80EEA is to boost the affordable housing segment, which is an important policy focus for the Indian government.

The deduction is available to individuals, but there are certain eligibility criteria and conditions that must be fulfilled to avail of this benefit. It is applicable only to home loans taken for the purchase of a residential house property and does not apply to loans taken for the construction or repair of an existing house.

Section 80EEA vs Section 80EE: Key Differences

Before we dive deeper into 80EEA, it’s important to understand how it differs from Section 80EE. Both sections offer tax relief on home loan interest, but there are important distinctions:

1. Eligibility Criteria

- Section 80EE: This section applies to individuals who are first-time homebuyers and have a home loan. However, it has certain conditions:

- The loan must be sanctioned by a financial institution in the financial year.

- The loan amount must not exceed ₹35 lakh.

- The value of the property must not exceed ₹50 lakh.

- The maximum deduction available under Section 80EE is ₹50,000 per year on home loan interest.

- Section 80EEA: Section 80EEA, on the other hand, targets affordable housing more explicitly and is available to individuals who meet the following conditions:

- The loan must be taken for the purchase of a residential house property.

- The loan must be sanctioned by a financial institution or housing finance company.

- The property must not exceed ₹45 lakh in value.

- The borrower’s income should be less than ₹6 lakh per year, and the loan must be sanctioned between 1st April 2019 and 31st March 2022 (extended in the 2022 budget).

- The deduction limit is ₹1.5 lakh, which is higher than Section 80EE.

2. Maximum Deduction

- Section 80EE offers a deduction of up to ₹50,000 on home loan interest.

- Section 80EEA provides a higher deduction of up to ₹1.5 lakh on home loan interest.

3. Applicability of the Section

- Section 80EE is available for taxpayers who are first-time homebuyers. The conditions here include the property price limit and the loan amount.

- Section 80EEA focuses on taxpayers purchasing affordable housing, where the loan amount and property price are below specified limits.

4. Duration of Benefit

- Section 80EE has no specific time frame for its applicability. It remains available until the home loan is repaid.

- Section 80EEA was initially introduced with a deadline in March 2022 but was later extended for a few years due to the COVID-19 pandemic and the government’s push to promote affordable housing.

In short, Section 80EEA offers a greater deduction than 80EE, especially for those purchasing homes in the affordable housing segment.

Section 80EEA Deduction: Key Features

1. Eligibility Criteria for Section 80EEA Deduction

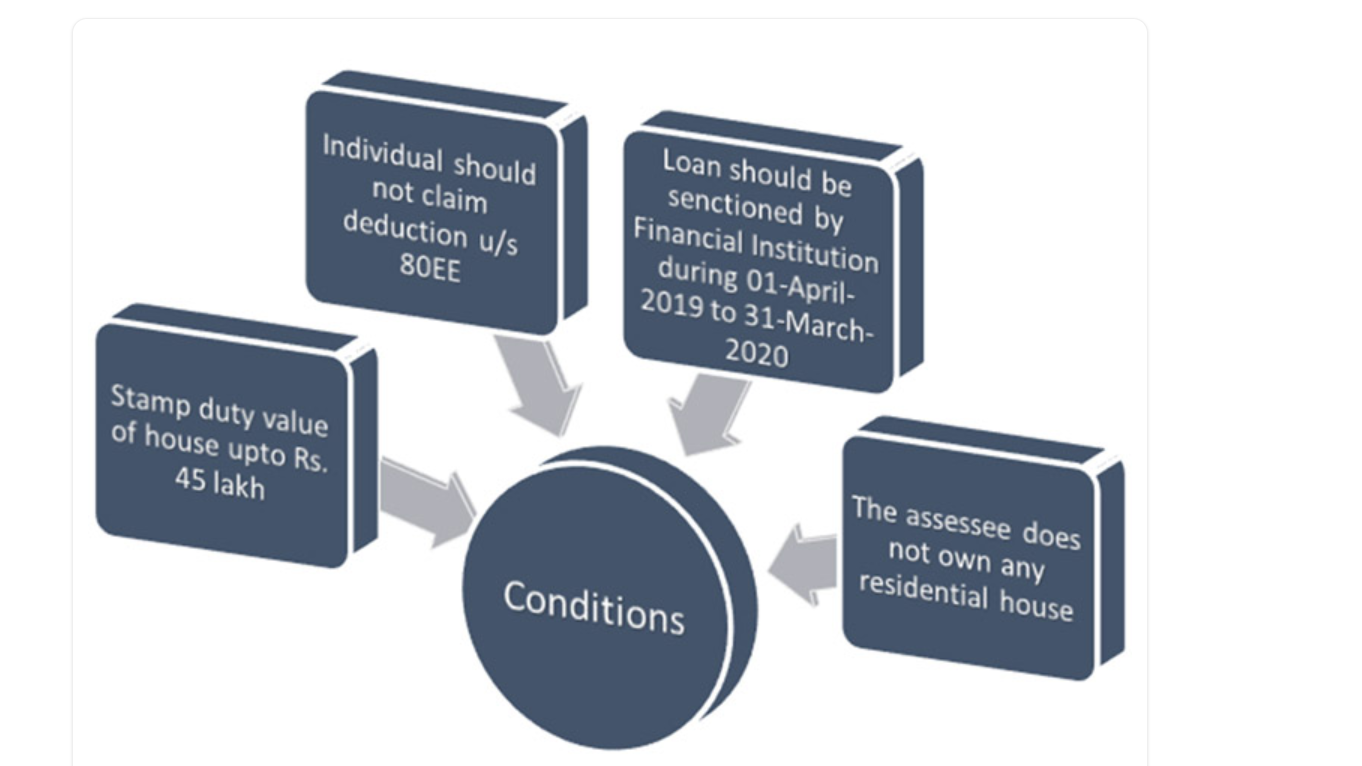

To claim the 80EEA deduction, the following conditions must be met:

- First-time Homebuyer: The taxpayer must be a first-time homebuyer, which means they should not have owned any residential property before.

- Loan for Residential Property: The loan must be taken for purchasing a new residential property.

- Property Value Limit: The value of the residential property should not exceed ₹45 lakh.

- Income Limit: The borrower’s annual income must be less than ₹6 lakh.

- Home Loan Sanctioned Between 1st April 2019 and 31st March 2022: Initially, the loan must have been sanctioned during this period, but the scheme was extended in the 2022 Union Budget.

- Amount of Deduction: A maximum of ₹1.5 lakh is available as a deduction under Section 80EEA.

2. How is the Deduction Calculated?

The 80EEA deduction applies only to the interest paid on the home loan. The deduction can be claimed under the following steps:

- Determine the amount of interest paid on the home loan during the financial year.

- Ensure that the loan qualifies under the eligibility conditions (loan taken for a residential property, value of property does not exceed ₹45 lakh, and the borrower’s income is below ₹6 lakh).

- Deduct up to ₹1.5 lakh of the interest paid from the taxable income.

For example, if you paid ₹2 lakh in home loan interest during the year and the loan qualifies for the 80EEA deduction, you can claim a deduction of up to ₹1.5 lakh.

3. Tax Impact of Section 80EEA

The 80EEA deduction directly reduces your taxable income, which in turn reduces the amount of tax you owe. By claiming this deduction, you reduce your overall taxable income, and as a result, you pay less tax.

4. Important Considerations

- The 80EEA deduction is available only on the interest component of the home loan, not the principal repayment.

- This deduction is in addition to the deductions available under Section 24(b) (deduction of up to ₹2 lakh on home loan interest) and Section 80C (deduction on principal repayment).

- The 80EEA deduction can be claimed only by an individual and not by HUFs or companies.

P.C. – tax2win.in

Section 80E, Section 80EEB, and Other Deductions

In addition to Section 80EEA, several other sections are related to home loan deductions. Here’s a quick overview of some of the relevant sections:

1. Section 80E: Education Loan Interest Deduction

Section 80E provides deductions on the interest paid on education loans. This section is different from the others because it applies to education loans rather than home loans. There’s no maximum limit under this section, but it is available only for education loans and not for home loans.

2. Section 80EEB: Deduction on Electric Vehicle Loan Interest

Section 80EEB was introduced in the 2020 Budget to promote the adoption of electric vehicles in India. Under this section, individuals can claim a tax deduction of up to ₹1.5 lakh on the interest paid on loans taken for purchasing an electric vehicle.

3. Section 24(b): Deduction on Home Loan Interest

In addition to the 80EEA deduction, taxpayers can also claim deductions under Section 24(b) of the Income Tax Act. This section provides a tax deduction of up to ₹2 lakh on the interest paid on home loans for self-occupied property. The 80EEA deduction can be claimed alongside Section 24(b).

How to Claim 80EEA Deduction?

To claim the 80EEA deduction, follow these steps:

- Ensure Eligibility: Verify that you meet all the criteria for 80EEA, such as the loan amount, property value, income limit, etc.

- Calculate Interest Paid: Determine the total interest paid on your home loan for the financial year.

- Fill in the Income Tax Return (ITR): While filing your tax return, ensure you declare the amount of home loan interest you’ve paid and enter the eligible deduction under Section 80EEA.

- Attach Loan Documents: Keep all documents related to the loan, such as the loan sanction letter, interest certificate from the bank, and property documents, handy.

The deduction is available under the Income from House Property section in the ITR form, and you can claim it while filing your ITR.

FAQs About Section 80EEA and Home Loan Tax Deductions

1. What is Section 80EEA?

Section 80EEA allows first-time homebuyers to claim a deduction of up to ₹1.5 lakh on home loan interest payments for the purchase of an affordable residential property.

2. What is the difference between Section 80EE and 80EEA?

Section 80EE offers a ₹50,000 deduction on home loan interest, while Section 80EEA provides a higher deduction of ₹1.5 lakh for affordable housing.

3. Can I claim both Section 80EE and 80EEA deductions?

No, you can claim only one of the deductions. However, you can also claim a deduction under Section 24(b) for home loan interest up to ₹2 lakh.

4. Is there any income limit for claiming Section 80EEA?

Yes, to claim a deduction under 80EEA, your annual income must be below ₹6 lakh.

5. Can I claim the deduction for a property that is not self-occupied?

Yes, the property does not have to be self-occupied for claiming the 80EEA deduction. The property can be rented out.

6. How do I claim the Section 80EEA deduction?

To claim the deduction, you need to file your income tax return and enter the interest amount you paid on the home loan under the appropriate section.

7. Is Section 80EEA applicable for loans taken for property construction?

No, 80EEA is only applicable to loans taken for purchasing residential properties, not for construction or repairs.

8. Is there a time limit for availing of the 80EEA deduction?

Yes, the loan must be sanctioned between 1st April 2019 and 31st March 2022, though this has been extended in subsequent budgets.

9. Can I claim Section 80EEA for multiple properties?

Yes, as long as each property qualifies under the eligibility criteria for 80EEA, you can claim deductions for multiple properties.

10. What documents are required to claim Section 80EEA?

You need to provide documents like the loan sanction letter, interest certificate, property documents, and proof of income.

Conclusion

Section 80EEA offers significant tax relief for first-time homebuyers who have purchased affordable housing. With a deduction of up to ₹1.5 lakh on the home loan interest, this section provides a substantial financial benefit and makes it easier for individuals to own a home.

By understanding the 80EEA deduction, comparing it with similar sections like 80EE and 80E, and ensuring eligibility, you can make the most of this provision and reduce your taxable income. Always stay updated with the latest budget announcements to make sure you are claiming the most relevant deductions.

For more details, you can visit the official Income Tax Department website.

Also Read: Comprehensive Guide to Section 194J of the Income Tax Act: Understanding TDS on Professional and Consultancy Fees

Also visit: Online Legal Service, Virtual Advice and Consultation