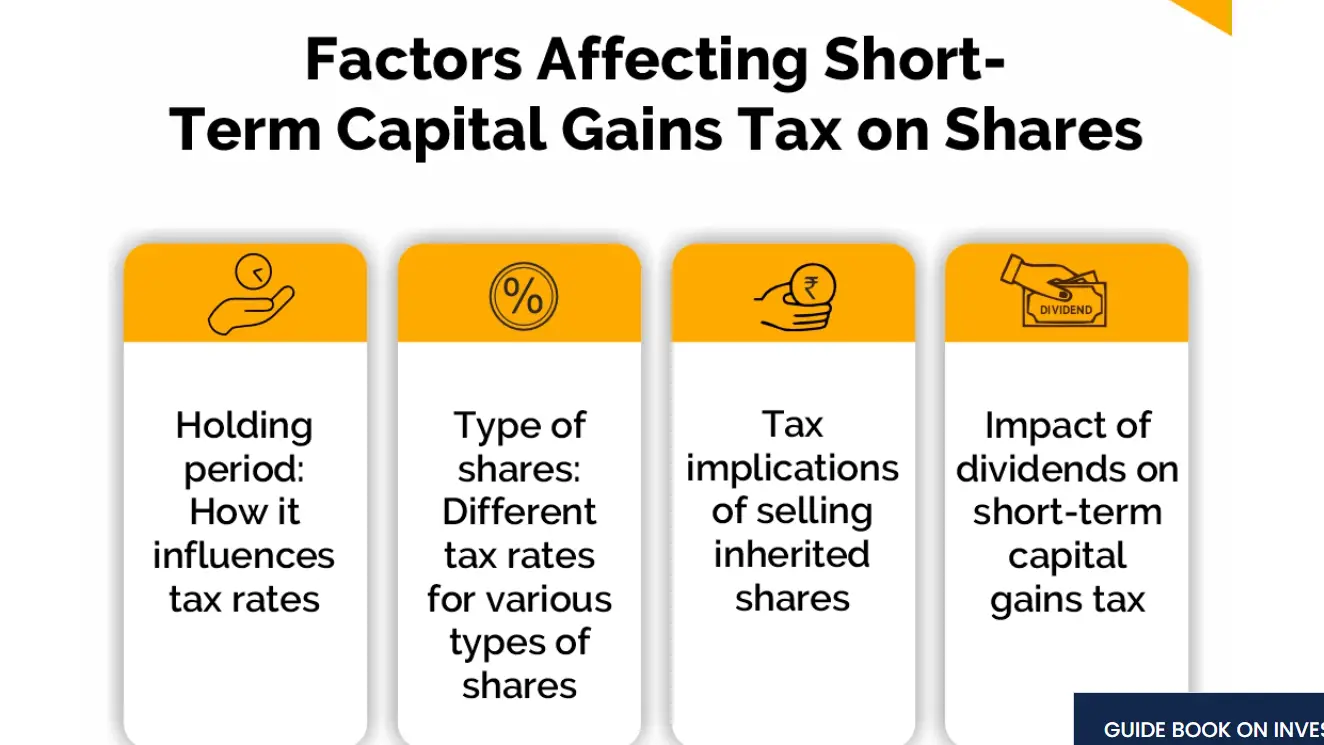

Short term capital gain tax on shares is one of the key components of the Indian tax system, particularly for investors who trade in shares, mutual funds, and other equity-oriented instruments.

Table of Contents

Understanding Short Term Capital Gains Tax on shares

When an investor sells an asset, such as shares, before holding it for a year, the profit from the sale is considered a short-term capital gain. The tax imposed on such gains is known as short-term capital gains tax (STCG tax). In India, the taxation of STCG on shares is governed by the provisions outlined in Section 111A of the Income Tax Act.

Taxation on Equity and Equity-Oriented Assets

Shares, stocks, and equity mutual funds are considered equity or equity-oriented assets. According to Section 111A of the Income Tax Act, if an investor sells these assets within a short term (less than one year for shares), the gains are taxable as STCG at a fixed rate.

Key Points about Short-Term Capital Gains Tax on Shares:

- Tax Rate for Equity Shares: If an individual sells shares or equity mutual funds listed on the stock exchange and the holding period is less than one year, the profit is taxable at a rate of 15%. This rate is significantly lower than the regular income tax rates applicable to other income sources.

- Transaction on Stock Exchange: To qualify for this lower tax rate, the transaction must be done on a recognized stock exchange, and securities transactions tax (STT) must be paid at the time of the sale.

- Definition of Short-Term Holding Period: According to the Income Tax Act, shares or equity mutual funds are considered short-term assets if they are held for less than 12 months. The holding period starts from the date of purchase of the asset until the date of its sale.

- STT (Securities Transaction Tax): STT is a tax levied on all transactions conducted on recognized stock exchanges. The payment of STT is mandatory to avail of the 15% tax benefit under Section 111A.

- Tax Treatment on Long-Term Holdings: If shares or mutual funds are held for over 12 months, the gains from their sale qualify as long-term capital gains (LTCG), which, as per current tax provisions, are exempt up to ₹1 lakh per financial year.

Legal Framework: Section 111A of the Income Tax Act

Section 111A of the Income Tax Act of India specifically deals with the taxation of short-term capital gains arising from the sale of equity shares or equity mutual funds. This section provides for the tax rate of 15% on STCG, provided the following conditions are met:

- The securities or shares must be listed on a recognized stock exchange.

- The transaction must attract the Securities Transaction Tax (STT).

- The shares or mutual funds must be held for less than 12 months.

Overview of Section 111A:

- Sec 111A(1): This section provides a special provision for the taxation of short-term capital gains in the case of listed equity shares and equity mutual funds.

- Sec 111A(2): The tax rate on short-term capital gains in this case is 15%, provided the securities transaction tax is paid.

Calculation of Short-Term Capital Gains

To calculate the short-term capital gains on shares, you need to subtract the cost of acquisition (including brokerage charges) from the selling price of the shares. The formula is:

Short-Term Capital Gain = Selling Price – (Purchase Price + Expenses)

Example:

Let’s say you bought 100 shares of a company at ₹500 each. After six months, you sell them at ₹600 each. Your calculation would look like:

- Purchase price = ₹500 × 100 = ₹50,000

- Selling price = ₹600 × 100 = ₹60,000

- Short-term capital gain = ₹60,000 – ₹50,000 = ₹10,000

In this example, the short-term capital gain is ₹10,000, and if the STT is paid, the tax payable would be 15% of ₹10,000 = ₹1,500.

Latest Updates on Short-Term Capital Gains Tax

- Securities Transaction Tax (STT) Update: STT continues to be one of the key requirements for qualifying for the 15% tax rate on short-term capital gains. Any transaction involving the sale of shares or equity mutual funds on a recognized stock exchange attracts STT.

- Taxation on Non-Equity Assets: The STCG tax rate on assets other than equity shares, such as real estate or gold, is higher and varies depending on the asset class.

- Rollover of Gains: There has been no major change regarding the rollover of gains from equity assets in the recent updates, and the treatment remains the same.

Exemptions and Deductions

- STCG on Listed Shares: Under Section 111A, short-term capital gains arising from the sale of listed equity shares or equity mutual funds that are subject to STT are taxed at 15%.

- Exemption of LTCG: As of now, long-term capital gains on the sale of equity shares or equity mutual funds are exempt from tax up to ₹1 lakh in a financial year. If your gains exceed ₹1 lakh, they are subject to a 10% tax.

- No Exemption on STCG: There is no exemption or deduction available for STCG under Section 111A. However, losses incurred from the sale of shares can be carried forward to offset gains in future years, subject to certain conditions.

Common FAQs on Short-Term Capital Gains Tax on Shares

1. What is short-term capital gains tax on shares?

STCG tax on shares refers to the tax payable on the profit earned from the sale of equity shares held for less than 12 months. In India, the tax rate is 15% on such gains, provided the transaction is done through a recognized stock exchange and the Securities Transaction Tax (STT) is paid.

2. How is STCG tax calculated?

STCG tax is calculated by subtracting the cost of acquisition of the shares (including brokerage and other expenses) from the sale price of the shares. The resulting gain is taxed at 15%.

3. What is Section 111A of the Income Tax Act?

Section 111A provides the tax rate of 15% on short-term capital gains arising from the sale of listed equity shares and equity mutual funds, subject to the payment of Securities Transaction Tax (STT).

4. How much tax do I pay on short-term capital gains from shares?

The tax rate on short-term capital gains from shares is 15% under Section 111A of the Income Tax Act, provided that STT is paid on the transaction.

5. Do I have to pay tax on every sale of shares?

Yes, if you make a profit from the sale of shares within a short-term holding period (less than 12 months), you will have to pay STCG tax. The tax is only applicable if you earn a profit.

6. Can I offset STCG losses against other income?

No, you cannot offset STCG losses against other income. However, STCG losses can be set off against other short-term capital gains under the same head of income. If losses remain after this, they can be carried forward to offset gains in the next 8 years.

7. What is the holding period for equity shares to be considered short-term?

For equity shares and equity mutual funds, a holding period of less than 12 months qualifies the gains as short-term. If held for more than 12 months, the gains are considered long-term capital gains.

P.C. – elearnmarkets.com

8. Is there any exemption for short-term capital gains tax?

Currently, there is no exemption available for short-term capital gains tax. However, long-term capital gains of up to ₹1 lakh per financial year are exempt from tax.

9. Do I need to file taxes on short-term capital gains?

Yes, you need to file taxes on short-term capital gains as part of your income tax return. The tax on STCG must be reported under the capital gains section of the return.

10. What is the impact of STT on short-term capital gains?

The payment of Securities Transaction Tax (STT) is a requirement for the lower 15% tax rate on STCG. Without paying STT, the gains may be taxed at higher regular income tax rates.

Conclusion

Short-term capital gains tax on shares is an essential aspect of the Indian taxation system, especially for those involved in trading and investing in the stock market. Understanding the provisions under Section 111A of the Income Tax Act helps investors manage their tax liabilities effectively. The tax rate of 15% on short-term capital gains is one of the benefits of trading in listed equity shares and equity mutual funds, provided the necessary conditions, such as paying Securities Transaction Tax, are met.

It is essential for investors to stay updated with any changes in tax laws and ensure they are compliant with the regulations to avoid any legal issues. Always consult with a tax expert or financial advisor to ensure you are maximizing your investment returns while staying within the framework of Indian tax laws.

For more information, you can refer to the official government website Income Tax Department or check the latest notifications from the Finance Ministry regarding tax policies.