Share capital is the money raised by a company through the issuance of shares to shareholders. It forms the financial backbone of a company, helping it to fund its operations, growth, and expansion. In the context of corporate finance, understanding the different types of share capital is crucial for investors, business owners, and financial analysts.

Table of Contents

What is Share Capital?

Share capital refers to the funds raised by a company through the issuance of shares to its shareholders. These funds are used by the company for various purposes such as expansion, operations, and debt repayment. The value of shares represents ownership in the company and comes with certain rights, including the right to vote and receive dividends.

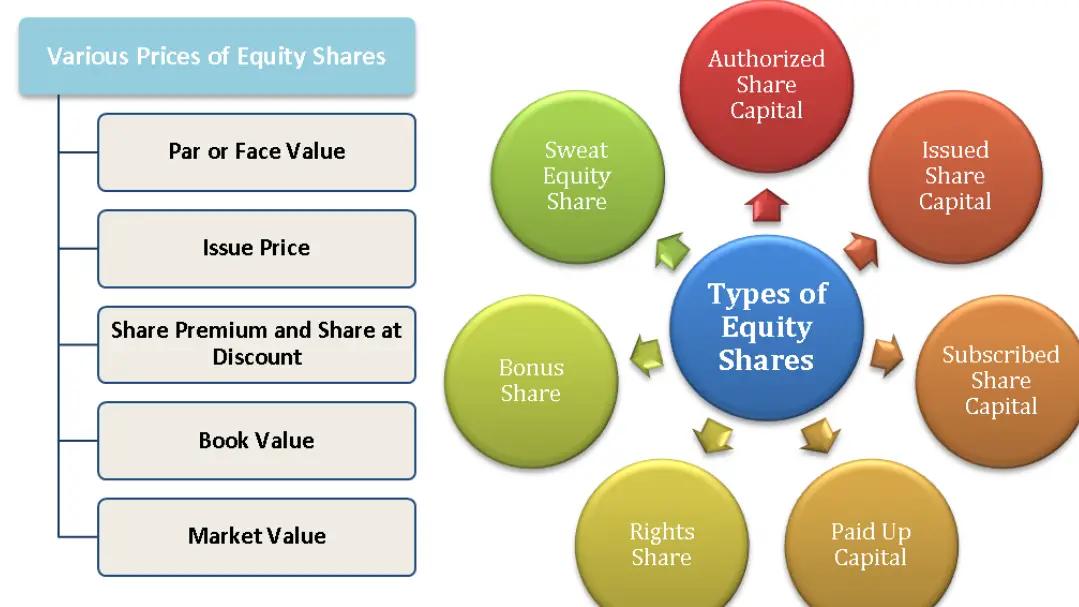

There are two main types of share capital in any company:

- Authorized Share Capital

- Issued Share Capital

However, the breakdown of share capital goes much deeper than this and is subdivided into several categories based on the company’s financial and legal structuring.

Categories of Share Capital

- Authorized Share Capital (Nominal Share Capital)

- Definition: The maximum value of shares that a company is authorized to issue to its shareholders. This amount is stated in the company’s Memorandum of Association (MOA) and can be increased or decreased by following proper legal procedures.

- Key Points:

- Does not reflect the actual amount raised by the company.

- Provides the company with flexibility to issue more shares in the future without requiring further approvals.

- Example: A company may authorize 10,000 shares at ₹10 each, amounting to ₹1,00,000 authorized capital.

- Issued Share Capital

- Definition: The portion of authorized share capital that the company has actually issued to shareholders in exchange for money, property, or other assets.

- Key Points:

- This is the amount raised by the company from the shareholders.

- Can be less than the authorized share capital, as the company does not need to issue all the authorized shares at once.

- Example: If the company issues 5,000 shares of ₹10 each, its issued share capital will be ₹50,000.

- Subscribed Share Capital

- Definition: The part of issued share capital that investors have agreed to purchase, and is reflected in the company’s shareholder registry.

- Key Points:

- This represents the shares that are officially taken up by investors.

- It is a subset of the issued share capital, and the company must record it accurately in its financial records.

- Example: A company may issue 10,000 shares but only 7,000 may be subscribed by investors.

- Paid-Up Share Capital

- Definition: The amount of capital that shareholders have actually paid for the shares they hold. It can be less than or equal to the subscribed share capital.

- Key Points:

- Represents the real investment in the company.

- If a company issues shares with a call option, part of the capital may remain unpaid until the call is made.

- Example: A company issues 1,000 shares at ₹10 each, and shareholders pay ₹8 per share upfront, so the paid-up capital is ₹8,000.

- Unpaid Share Capital

- Definition: The amount of capital that shareholders are required to pay but have not yet paid.

- Key Points:

- This typically occurs when shares are issued with a call for payments at a later time.

- Shareholders must pay the unpaid amount when called by the company.

- Example: A company may issue 1,000 shares at ₹10 each, with ₹5 unpaid. This means ₹5,000 of the share capital is unpaid.

- Preference Share Capital

- Definition: This is capital raised by issuing preference shares. Preference shareholders have preferential rights over ordinary shareholders when it comes to dividends and capital repayment.

- Key Points:

- Preference Shares do not carry voting rights but provide a fixed rate of dividend.

- Preference shareholders are paid dividends before ordinary shareholders.

- Types: Cumulative preference shares, Non-cumulative preference shares, Participating preference shares, and Redeemable preference shares.

- Example: A company issues 5,000 preference shares at ₹100 each, yielding a fixed dividend of 5% annually.

- Equity Share Capital

- Definition: Capital raised through the issuance of equity shares. Equity shareholders are the real owners of the company, having voting rights and receiving dividends based on company profits.

- Key Points:

- Equity Shares represent ownership in the company.

- The dividends are paid based on the profits and may vary each year.

- Example: A company issues 50,000 equity shares of ₹10 each, totaling ₹500,000 equity share capital.

- Convertible Share Capital

- Definition: Shares that can be converted into another class of shares, typically from preference shares to equity shares.

- Key Points:

- Convertible Preference Shares can be converted into equity shares after a specified period.

- This allows for increased ownership control over time.

- Example: A company may issue convertible preference shares that can be converted into equity shares after 5 years.

- Bonus Share Capital

- Definition: These are shares issued to existing shareholders as a “bonus” or “gift” by capitalizing the company’s reserves or profits. This does not involve a cash outflow.

- Key Points:

- Helps increase the liquidity of a company’s stock without requiring any cash investment.

- Shareholders get additional shares for free.

- Example: A company may issue 1 bonus share for every 5 shares held.

- Right Share Capital

- Definition: Shares issued to existing shareholders to raise additional capital. These shares are offered to shareholders at a discounted price in proportion to their current holdings.

- Key Points:

- Provides existing shareholders with the right to purchase additional shares at a discounted price.

- Typically offered to raise funds without diluting control.

- Example: A company may offer one new share for every 10 shares held at a discounted price of ₹8 instead of the market value of ₹10.

P.C. – efinancemanagement.com

Latest Trends and Legal Updates

- SEBI Guidelines on Share Capital: The Securities and Exchange Board of India (SEBI) has introduced several reforms and guidelines that affect how companies can raise capital through equity and preference shares. Recent updates emphasize transparency in the issue of shares, particularly with respect to Initial Public Offerings (IPOs) and Rights Issues.

- Corporate Governance and Capital Structure: With evolving corporate governance norms, companies are now required to maintain a balance between equity and preference share capital to ensure that the interests of both shareholders and creditors are protected.

- Impact of the Companies (Amendment) Act, 2020: This Act introduced provisions for enhancing the ease of doing business, including simplifying the process for issuing and increasing share capital in private companies. Additionally, provisions relating to the issuance of preference shares have been revised to ensure more flexibility in capital raising.

- Global Trends in Share Capital: As companies worldwide seek funding through new financial instruments, convertible bonds and warrants have become increasingly common, influencing share capital structures, especially in tech startups and large corporations.

FAQs on Types of Share Capital

- What is the difference between authorized and issued share capital? Authorized share capital refers to the maximum amount a company can raise, while issued share capital is the actual amount the company has issued to shareholders.

- Can a company increase its authorized share capital? Yes, a company can increase its authorized share capital by passing a resolution in a general meeting and filing it with the relevant authorities.

- What are preference shares? Preference shares are a type of share that provides shareholders with preferential treatment regarding dividends and capital repayment but generally do not carry voting rights.

- How is paid-up capital different from subscribed capital? Subscribed capital refers to the total shares taken by the investors, while paid-up capital is the portion of that capital that has already been paid by the investors.

- Can a company issue bonus shares without paying dividends? Yes, a company can issue bonus shares by capitalizing its reserves or profits without paying any cash dividends.

- What is convertible share capital? Convertible share capital refers to shares, typically preference shares, that can be converted into another class of shares, such as equity shares.

- Is there any limit on the number of preference shares a company can issue? There is no fixed limit, but the company must adhere to regulatory provisions and maintain transparency while issuing preference shares.

- What is the purpose of issuing right shares? Right shares are issued to existing shareholders to raise additional capital without diluting control, as they are offered at a discounted price relative to market value.

- What is the significance of bonus shares in the capital structure? Bonus shares help improve liquidity and increase the number of shares in circulation without requiring new investments from shareholders.

- How do preference and equity shares differ in terms of shareholder rights? Preference shareholders have a fixed dividend and priority during liquidation but do not have voting rights. In contrast, equity shareholders have voting rights and dividends that fluctuate based on the company’s performance.

Conclusion

Understanding the various types of share capital is vital for investors, business owners, and corporate professionals. The flexibility and structure of share capital allow companies to raise funds efficiently while balancing the interests of shareholders, creditors, and the company’s financial stability. As corporate law and financial markets continue to evolve, staying informed about the latest legal and financial guidelines for share capital remains crucial.

References

- Byju’s – Categories of Share Capital

- iPleaders – Shares and Share Capital of the Company

- Securities and Exchange Board of India (SEBI) Official Website

- Companies (Amendment) Act, 2020

Also Read: Cognizable and Non-Cognizable Offences: Everything You Need to Know

Also visit: Online Legal Service, Virtual Advice and Consultation

Also Read: The Ultimate Guide to MoviesMod: Everything You Need to Know