When it comes to calculating the tax liabilities associated with capital gains, the Indexation Chart plays a crucial role. It can significantly affect the taxable amount of capital gains, especially in the context of long-term capital assets. In India, the Cost Inflation Index (CII), or Indexation Benefit, is a vital aspect of the taxation process that allows individuals and businesses to adjust the cost of acquisition of their assets to account for inflation.

Table of Contents

What is Indexation Chart?

Indexation is a process that adjusts the original cost of an asset to account for inflation over a period. The Cost Inflation Index (CII) is the official mechanism used by the government of India to calculate the adjusted cost of acquisition for long-term assets.

When you sell an asset such as property, gold, or stocks, the capital gains are calculated by deducting the cost of acquisition from the selling price. However, if the asset has been held for a long time, the original cost can be significantly lower than its current value due to inflation. Indexation helps adjust the cost of acquisition to reflect this inflation, reducing your capital gains tax liability.

Why is Indexation Important?

Indexation becomes especially important when calculating long-term capital gains (LTCG). In the case of long-term investments, the indexed cost of acquisition can be substantially higher than the original cost, leading to lower taxable capital gains. This adjustment is made by applying the Cost Inflation Index to the acquisition cost.

For instance, if you bought a property 10 years ago at ₹10,00,000 and sold it today for ₹50,00,000, your capital gain would typically be ₹40,00,000 (₹50,00,000 – ₹10,00,000). However, with indexation, you can adjust the acquisition cost using the Cost Inflation Index Table, which will result in a lower taxable capital gain.

Cost Inflation Index (CII)

The Cost Inflation Index (CII) is an index published by the Income Tax Department of India every year. It is used to adjust the original cost of acquisition for inflation over the years. The CII is an essential tool in calculating long-term capital gains because it allows taxpayers to reduce their taxable capital gains by factoring in the loss of value of money due to inflation.

The CII is updated every year and is applied to the indexed cost of acquisition. The government issues the CII annually as a part of the Union Budget, which taxpayers can use to adjust the purchase price of an asset to its present-day value.

The Cost Inflation Index Table

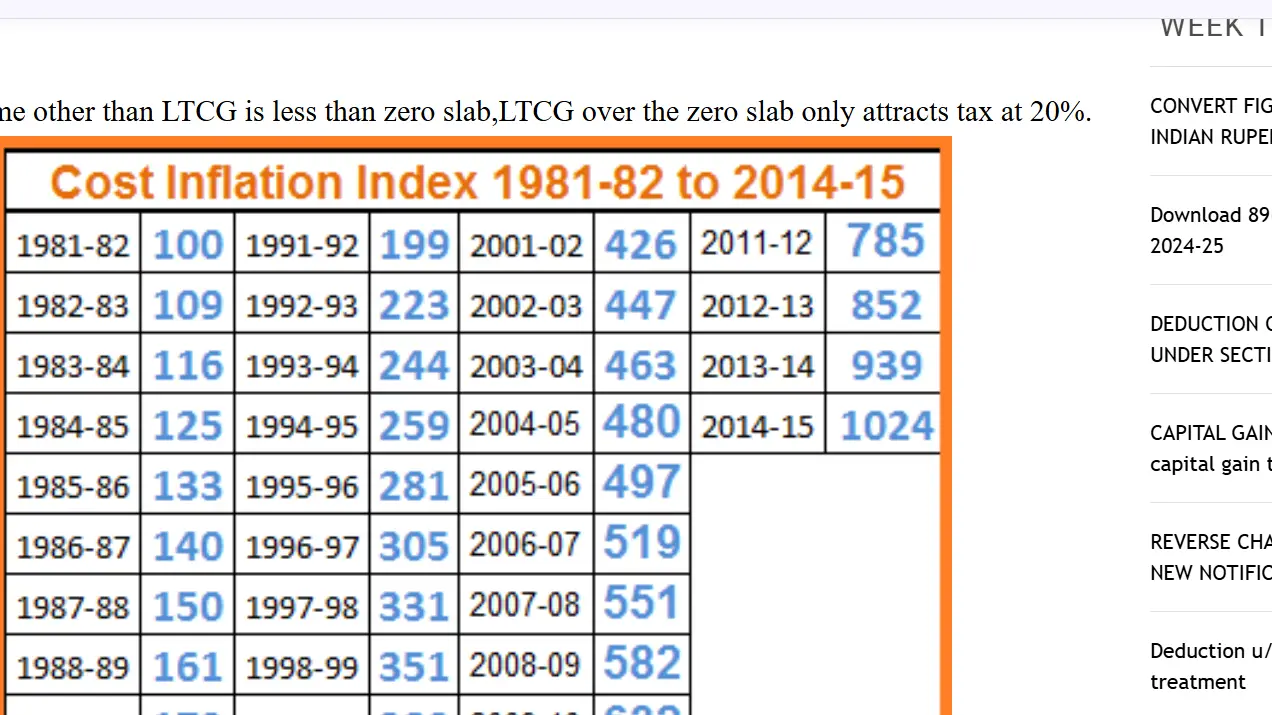

The Cost Inflation Index Table provides the annual CII values for each year since 1981, when the indexation system was introduced. The CII value for the base year (1981-82) is set at 100. For every subsequent year, the CII increases based on inflation, which is used to calculate the adjusted cost of acquisition.

Cost Inflation Index Table for FY 2024-25 (Example)

| Year of Sale | CII Value |

|---|---|

| 1981-82 | 100 |

| 1982-83 | 109 |

| 1983-84 | 116 |

| 1984-85 | 125 |

| … | … |

| 2024-25 | 348 |

Note that the table provided above is just an example. The full CII table is available on the official Income Tax Department website.

How is Indexation Used in Calculating Capital Gains?

The indexed cost of acquisition is calculated by multiplying the original cost of acquisition by the ratio of the CII of the year of sale to the CII of the year of purchase. The formula for calculating the indexed cost of acquisition is:Indexed Cost of Acquisition=CII of Year of SaleCII of Year of Purchase×Original Cost of Acquisition\text{Indexed Cost of Acquisition} = \frac{\text{CII of Year of Sale}}{\text{CII of Year of Purchase}} \times \text{Original Cost of Acquisition}Indexed Cost of Acquisition=CII of Year of PurchaseCII of Year of Sale×Original Cost of Acquisition

Example of Indexation in Action

Let’s consider the example of a property bought in 2010-11 for ₹15,00,000, and sold in 2024-25. To calculate the indexed cost of acquisition:

- Original cost of acquisition: ₹15,00,000

- CII for 2010-11: 167

- CII for 2024-25: 348

The indexed cost of acquisition would be calculated as follows:Indexed Cost of Acquisition=348167×15,00,000=₹31,34,123\text{Indexed Cost of Acquisition} = \frac{348}{167} \times 15,00,000 = ₹31,34,123Indexed Cost of Acquisition=167348×15,00,000=₹31,34,123

So, the indexed cost of acquisition would be ₹31,34,123. This means, when you sell the property, your taxable capital gain will be calculated using ₹31,34,123 instead of ₹15,00,000, reducing the taxable amount significantly.

Benefits of Indexation

- Reduced Capital Gains Tax: The primary benefit of indexation is that it reduces the capital gains tax. By adjusting the cost of acquisition for inflation, the capital gain is reduced, leading to lower taxes.

- Increased Tax Efficiency: Indexation makes long-term investments more tax-efficient by accounting for inflation, allowing investors to retain more of their gains.

- Fairness in Taxation: It ensures that the taxpayers are not penalized for inflation, which can erode the real value of their gains.

Indexation Table

The indexation table is an essential tool for calculating the indexed cost of acquisition. It helps you to find the correct CII for any given year, enabling accurate calculations of long-term capital gains.

P.C. – simpletaxindia.net

Example of Using the Indexation Table

Let’s assume an investor bought an asset in 2010-11 for ₹20,00,000 and is selling it in 2024-25. The CII for these years can be found in the Cost Inflation Index Table:

- CII for 2010-11: 167

- CII for 2024-25: 348

Now, we can calculate the indexed cost of acquisition:Indexed Cost of Acquisition=348167×20,00,000=₹41,76,635\text{Indexed Cost of Acquisition} = \frac{348}{167} \times 20,00,000 = ₹41,76,635Indexed Cost of Acquisition=167348×20,00,000=₹41,76,635

The indexed cost of acquisition is ₹41,76,635, which reduces the taxable capital gain when the asset is sold.

What is Indexation Benefit?

The Indexation Benefit is the reduction in taxable capital gains achieved by adjusting the cost of acquisition for inflation. By applying the CII to the original purchase price, taxpayers can increase their cost base, which lowers the taxable gain on the asset when sold.

This benefit is particularly valuable for long-term investments, such as property or stocks held for several years. Without indexation, the capital gains would be calculated based on the original cost, leading to higher taxes.

Key Terms Related to Indexation

- Indexed Cost of Acquisition: The adjusted cost of an asset, accounting for inflation.

- Capital Gain Index: Refers to the CII used to calculate long-term capital gains tax.

- Index of 83: This refers to the CII for the year 1983-84, which serves as a reference for the calculation of the indexed cost of acquisition.

- Capital Gains Tax: The tax imposed on the profit from the sale of assets.

Latest Updates on Indexation

As of the latest budget announcements and government provisions, indexation continues to be an essential tool for reducing the tax burden on long-term capital gains. The government updates the Cost Inflation Index Table annually, adjusting it for inflation to ensure fairness in taxation. Taxpayers must stay updated on the new CII values published in the Union Budget each year.

How to Use Indexation in Your Tax Filings?

To make use of the indexation benefit, taxpayers must provide details of their asset’s acquisition date, purchase price, and the year of sale while filing their income tax returns. They must use the appropriate CII values as per the official table to calculate the indexed cost of acquisition and reduce their taxable capital gains.

FAQs About Indexation

1. What is the Cost Inflation Index (CII)?

The CII is a measure provided by the Indian government to adjust the cost of acquisition of long-term capital assets for inflation.

2. How is the CII calculated?

The CII is updated annually and published in the Union Budget. It is used to calculate the adjusted cost of acquisition of assets.

3. What is the purpose of indexation?

Indexation allows taxpayers to account for inflation, reducing the taxable amount of capital gains when selling long-term assets.

4. Can indexation be applied to all assets?

Indexation benefits are typically available for long-term assets like property, bonds, and stocks, provided they are held for more than 36 months.

5. How does indexation affect capital gains tax?

By increasing the cost of acquisition, indexation reduces the capital gains tax liability on the profit from the sale of the asset.

6. Is indexation applicable to short-term capital gains?

No, indexation is only applicable to long-term capital gains.

7. How can I download the CII table?

The official Cost Inflation Index table is available on the Income Tax Department website.

8. What is the benefit of using the indexation table?

The indexation table helps you find the appropriate CII value for any given year, making it easier to calculate the indexed cost of acquisition.

9. How do I calculate the indexed cost of acquisition?

The formula to calculate indexed cost is: Indexed Cost=CII of Year of SaleCII of Year of Purchase×Original Cost \text{Indexed Cost} = \frac{\text{CII of Year of Sale}}{\text{CII of Year of Purchase}} \times \text{Original Cost} Indexed Cost=CII of Year of PurchaseCII of Year of Sale×Original Cost

10. What happens if I sell an asset without using indexation?

Without indexation, you will have to pay tax on the full capital gain, which could result in a higher tax liability.

Conclusion

Indexation plays a crucial role in reducing the tax burden on long-term capital gains by adjusting the original cost of acquisition for inflation. By understanding how the Cost Inflation Index (CII) works and how to use the indexation table, taxpayers can significantly reduce their taxable capital gains, leading to lower taxes. This makes long-term investments more tax-efficient and encourages individuals to invest in assets that can appreciate over time.

Also Read: Understanding the Income Tax Act of 1961: Recent Updates, Amendments, and Key Insights

Also visit: Online Legal Service, Virtual Advice and Consultation

Also Read: TDR Status: Understanding the Process, Common Problems, and Legal Solutions