The Income-Tax Act 1961 News (ITA, 1961) serves as the cornerstone of India’s taxation framework. This Act governs how income is assessed, collected, and enforced across the country. Its relevance in contemporary India is immense, especially considering the economic changes, technological advancements, and evolving global tax standards. The Act has undergone several revisions, amendments, and updates over the years, making it crucial for taxpayers, businesses, and tax professionals to stay up to date.

Table of Contents

Chapter 1: Overview of the Income-Tax Act 1961 News

The Income-Tax Act 1961 news is the primary legal framework for the taxation of income in India. It covers the scope of taxation, provides definitions, and establishes the mechanisms of tax administration and collection. Key features include:

Structure of the Income Tax Act

- Sections: The Act is divided into multiple sections. Each section governs a different aspect of taxation, from defining what constitutes income to detailing the procedures for assessment, appeals, and penalties.

- Section 2 defines essential terms like “income,” “person,” “company,” and “taxpayer.”

- Section 10 includes various exemptions like agricultural income.

- Section 80 to Section 80U includes deductions and exemptions available to taxpayers, such as those for investments in PPF, EPF, insurance premiums, etc.

- Parts and Schedules: The Act has several parts and schedules that define the rates, exemptions, and procedures.

- Schedule 1: Deals with types of income and corresponding tax rates.

- Schedule 10: Contains rules for the taxation of capital gains.

Chapter 2: Recent Amendments to the Income Tax Act (Latest Updates)

Over the years, the Income Tax Act has seen regular amendments, primarily through the Union Budget and Finance Acts. Some of the notable recent amendments include:

1. Budget 2024 – Key Changes and Updates

The Union Budget 2024 presented some crucial tax reforms, especially targeting individuals, businesses, and the rapidly evolving digital economy. Key provisions include:

- Revised Tax Slabs for Individuals: The tax slabs for individuals have undergone slight revisions, with a focus on reducing the burden on lower and middle-income taxpayers.

- Corporate Tax Reforms:

- Reduced Corporate Tax Rates: Corporate tax rates have been reduced for domestic companies, with further reduction for new businesses involved in manufacturing.

- Tax Incentives for Startups: Startups registered under the Startup India scheme continue to enjoy a tax holiday and exemptions from capital gains tax.

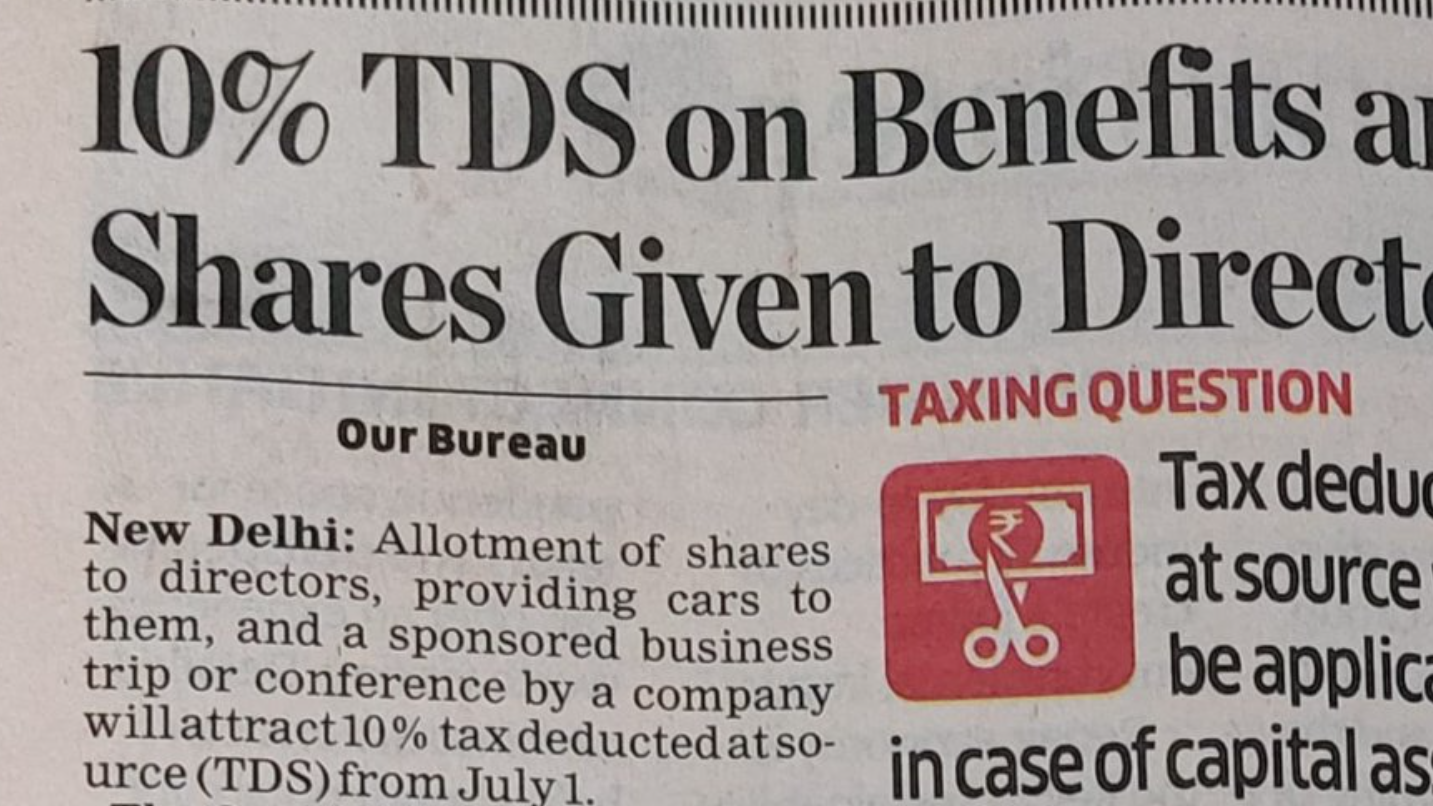

- E-Commerce and Digital Transactions: There has been an increased focus on taxing the digital economy. This includes modifications to the Tax Deducted at Source (TDS) provisions for e-commerce transactions and stricter compliance on Virtual Digital Assets (VDAs).

- Virtual Digital Assets (VDAs) Taxation: In 2023, the government introduced an explicit taxation regime for cryptocurrencies and NFTs (Non-Fungible Tokens). Under Section 115BBH, income derived from the transfer of VDAs is subject to a flat 30% tax, with no deductions allowed except for the cost of acquisition.

2. Amendments for Non-Resident Indians (NRIs)

In 2024, a major overhaul in the taxation of Non-Resident Indians (NRIs) occurred, including the extension of Double Taxation Avoidance Agreements (DTAAs) with several countries and updates on the taxation of global income for NRIs.

3. Updates to Capital Gains Taxation

Capital gains tax provisions have evolved, with specific changes made to the taxation of long-term capital gains (LTCG) and short-term capital gains (STCG). Section 54F was amended to provide greater clarity on exemptions for long-term capital gains from the sale of residential property.

Chapter 3: Key Provisions of the Income Tax Act 1961

1. Income Tax Rates

The Income Tax Act defines progressive tax rates, and the rates are adjusted annually during the Budget session. The tax structure is divided based on income slabs:

- Individuals below 60 years:

- Up to Rs. 2.5 lakh: No tax

- Rs. 2.5 lakh to Rs. 5 lakh: 5%

- Rs. 5 lakh to Rs. 10 lakh: 20%

- Above Rs. 10 lakh: 30%

- Senior Citizens (60 years and above): They enjoy a higher tax exemption limit of Rs. 3 lakh.

2. Deductions under Section 80C

Section 80C allows deductions for investments made in specified financial instruments such as:

- Public Provident Fund (PPF)

- Employees’ Provident Fund (EPF)

- Tax-saving Fixed Deposits

- Life Insurance Premiums

The total deduction allowed under Section 80C is Rs. 1.5 lakh per financial year.

3. Exemptions under Section 10

Section 10 deals with exemptions, including:

- Agricultural Income: Agricultural income is exempt from income tax under Section 10(1), although it is considered when determining tax rates for high-income earners.

4. Capital Gains Tax

Capital gains tax is levied on profits from the sale of capital assets like property, stocks, and bonds:

- Short-term capital gains (STCG): If the asset is held for less than 36 months (property) or 12 months (equity shares), it is subject to a tax of 15% for listed assets or as per relevant tax rates for others.

- Long-term capital gains (LTCG): Taxed at 20% with indexation benefits for assets held longer than 36 months (property) or 12 months (stocks).

Chapter 4: Recent Changes in Digital and E-commerce Taxation

The taxation of digital transactions, virtual assets, and e-commerce has undergone significant revisions in recent years:

1. Taxation of E-commerce Operators:

E-commerce platforms, like Amazon, Flipkart, etc., are now required to deduct TDS (Tax Deducted at Source) from payments made to sellers operating through their platforms. Under Section 194-O, these platforms are required to ensure TDS compliance for all payments made to e-commerce participants.

2. Taxation of Virtual Digital Assets (VDAs):

A breakthrough reform in 2023 targeted the taxation of digital assets, including cryptocurrencies and NFTs. These assets are now subject to a 30% tax rate, and investors cannot deduct any expenses, except for the cost of acquisition.

P.C. – legalmantra.net

Chapter 5: Corporate Taxation and International Taxation

Corporate taxation provisions under the Income Tax Act are periodically revised to accommodate global financial changes.

1. Transfer Pricing Regulations:

India’s Transfer Pricing Regulations under Section 92 ensure that multinational companies do not artificially shift profits to low-tax jurisdictions by manipulating the prices at which transactions occur between related entities.

2. International Taxation and Double Taxation Avoidance Agreements (DTAA):

The Indian government has entered into DTAA treaties with many countries, ensuring that income is not taxed twice. DTAAs allow taxpayers to claim relief from double taxation by providing credit for taxes paid in other countries.

Chapter 6: Filing Tax Returns – The Digital Transformation

The introduction of e-filing portals in recent years has made it easier for individuals and businesses to file their tax returns. Taxpayers can now complete their returns, check their tax status, and track their refunds online, significantly reducing paperwork.

1. E-filing of Tax Returns:

The Income Tax e-filing portal enables taxpayers to file returns, apply for PAN, track their refunds, and much more.

2. Pre-filled Tax Returns:

Taxpayers can now access pre-filled forms on the e-filing portal that automatically populate details like income, TDS, and tax deductions from various sources, making the filing process easier and reducing errors.

Chapter 7: Frequently Asked Questions (FAQs)

- What is the Income-Tax Act 1961 news?

- The Income Tax Act of 1961 is the primary legislation that governs the taxation of income in India.

- What are the new tax slabs introduced in 2024?

- Tax slabs for individuals have been revised slightly to reduce the burden on middle-income groups, with the highest tax rate of 30% on income above Rs. 10 lakh.

- Is agricultural income exempt from tax?

- Yes, agricultural income is exempt from tax under Section 10(1), provided it is derived from agricultural operations.

- How are digital assets like cryptocurrencies taxed?

- Digital assets are taxed at a flat rate of 30% under Section 115BBH with no deductions allowed except for the cost of acquisition.

- What are the requirements for e-commerce platforms regarding TDS?

- E-commerce platforms are required to deduct TDS from transactions made between buyers and sellers through the platform, as per Section 194-O.

- Can NRIs be taxed on their global income?

- Yes, residents are taxed on their global income, whereas NRIs are taxed only on income earned in India.

- What is the maximum deduction available under Section 80C?

- The maximum deduction available under Section 80C is Rs. 1.5 lakh for investments in specified financial instruments.

- What is the penalty for late filing of income tax returns?

- Penalties for late filing can include fines and interest, which increase as the delay extends.

- How are corporate taxes assessed?

- Corporate taxes are assessed based on income, turnover, and applicable deductions under corporate tax provisions.

- How can I file my income tax return online?

- You can file your tax return through the official Income Tax e-Filing Portal, which is available at www.incometaxindia.gov.in.

Conclusion

The Income Tax Act of 1961 continues to evolve in response to global economic trends, digital advancements, and local challenges. The amendments and provisions of this Act not only aim to simplify the tax structure but also ensure fairness and efficiency in the Indian tax system. Whether you are an individual taxpayer, a corporate entity, or a digital entrepreneur, staying informed about the latest updates in the Income Tax Act is crucial for compliance and financial planning.

Citations

- Income Tax Department – Official Website: www.incometaxindia.gov.in

- Budget 2024 Amendments: Finance Ministry

- Taxation of Virtual Digital Assets: Ministry of Finance – VDAs

- Double Taxation Avoidance Agreements (DTAA): Ministry of Finance

This expanded structure provides a comprehensive view of the Income Tax Act of 1961, covering both recent amendments and detailed provisions. Each section can be expanded with examples, case studies, and expert commentary to reach the desired word count.

Also Read: Comprehensive Guide to Section 194J of the Income Tax Act: Understanding TDS on Professional and Consultancy Fees

Also visit: Online Legal Service, Virtual Advice and Consultation